Sustainable Growth of Local Businesses

We will contribute to the sustainable growth of local companies by working together as a group to provide high value-added solutions that deeply engage the management strategies of our customers by sincerely addressing the issues they face.

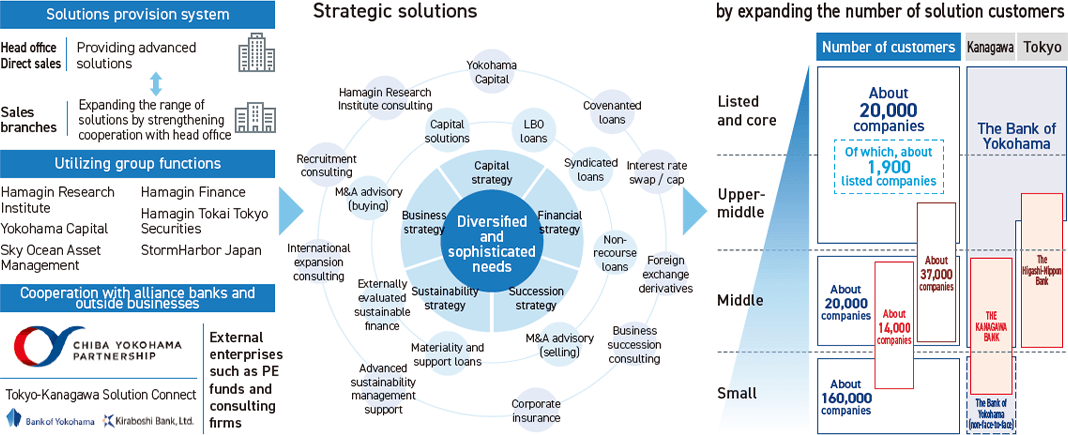

Provide solutions utilizing group and alliance functions etc.

We aim to be the fi rst choice as a partner for our clients by utilizing group functions and deepening cooperation with outside businesses, by strengthening the provision of strategic solutions that deeply engage management strategies for business, finance and capital, and by responding to increasingly diverse and sophisticated needs.

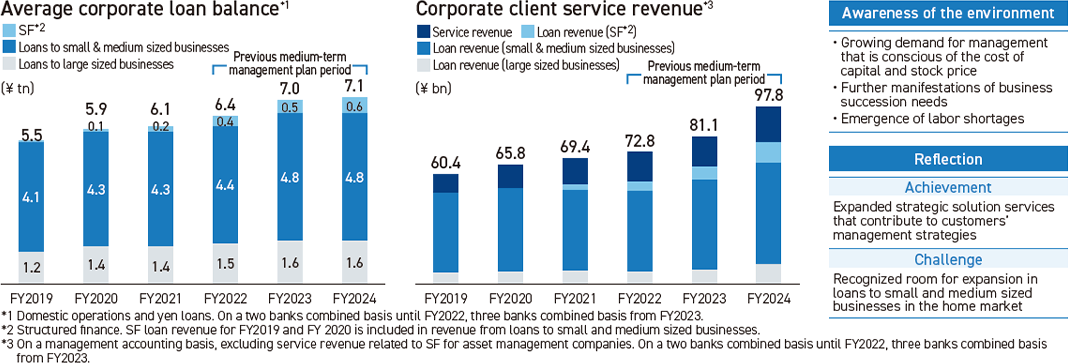

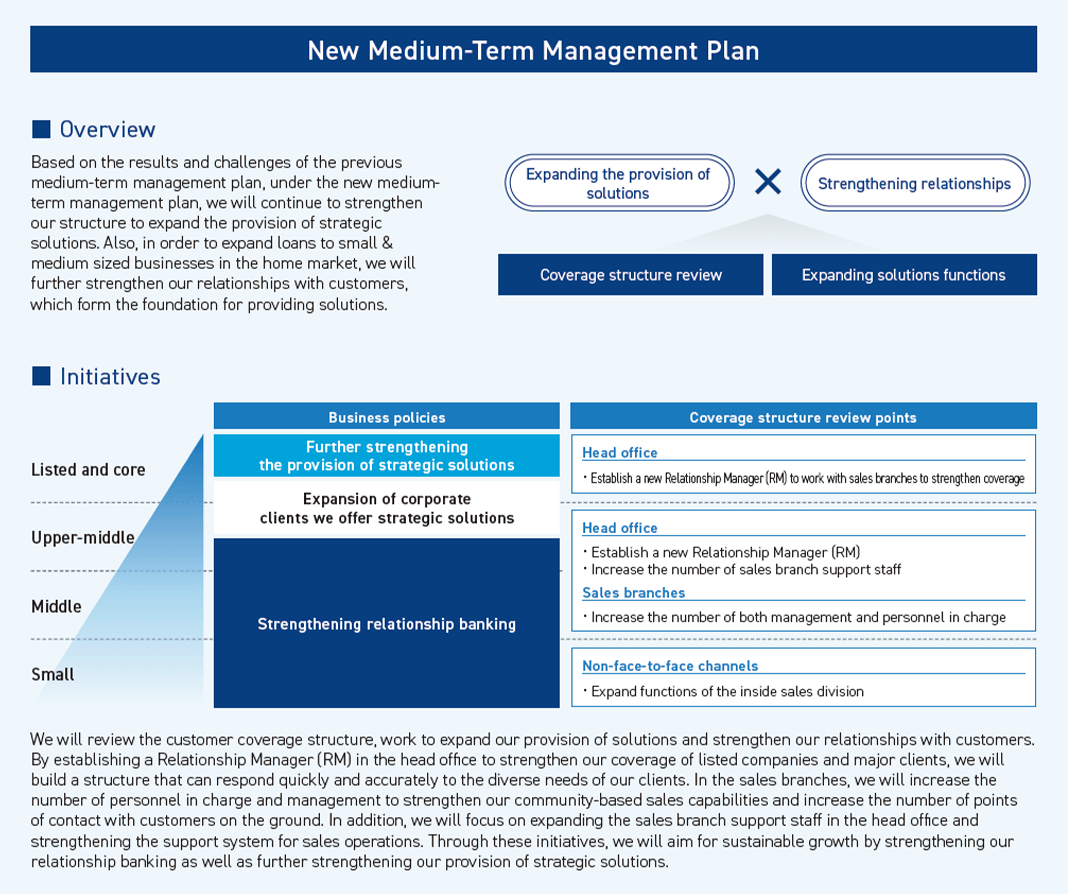

Recognize achievements and issues in the previous medium-term management plan

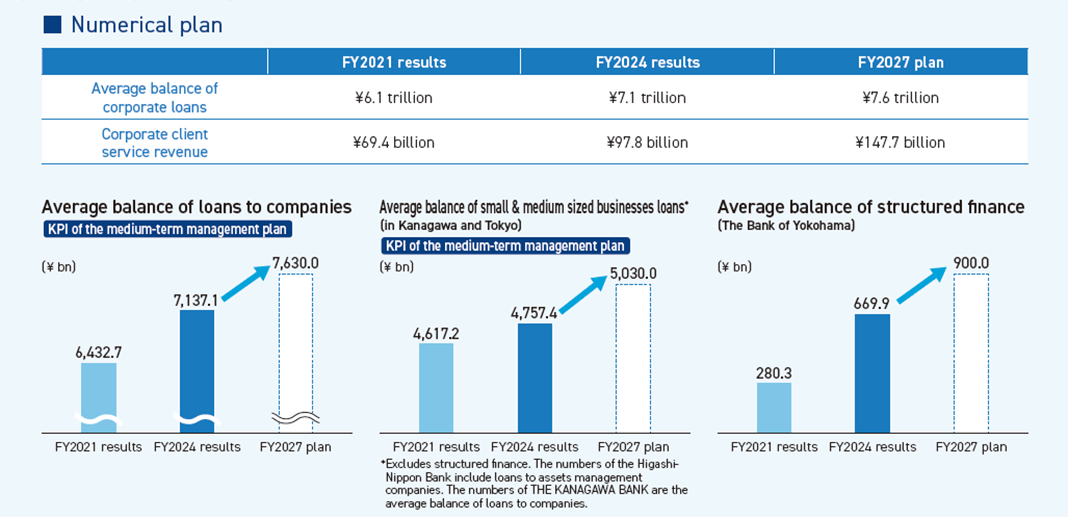

In the previous medium-term management plan, we expanded loan balance and corporate client service revenue mainly through structured finance, which is a highly profi table asset, by strengthening our provision of strategic solutions. On the other hand, we recognize that there is room for further growth in loans to small & medium sized businesses, given the growth potential of the home market.

Source of strengths in the solution business

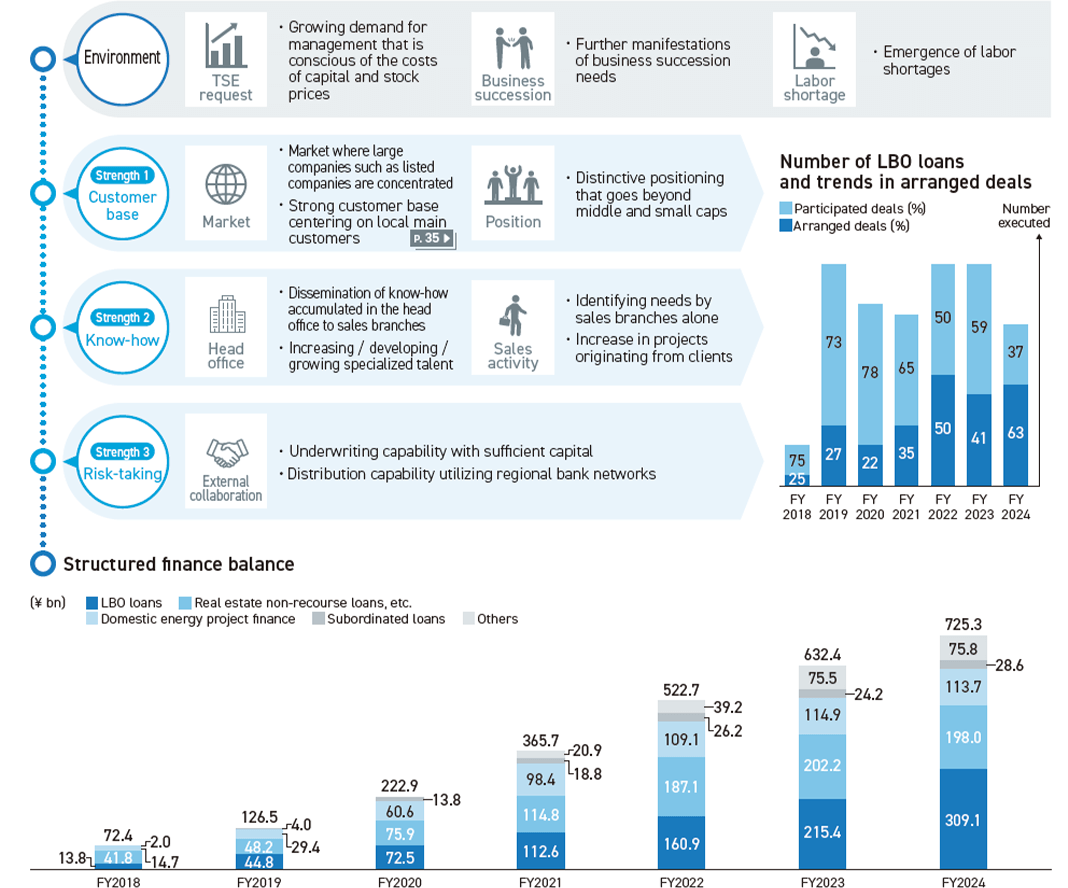

The strengths of the Group's solution business lie in its strong customer base, advanced solution provision know-how and risk-taking capacity backed by sound capital. The Group has opportunities to provide strategic solutions by utilizing the customer base it has cultivated over many years in Kanagawa Prefecture and Tokyo, where customers, both small and medium-sized customers and large customers such as listed companies, are concentrated. In 2019, we established the Financial Solutions Department, a direct sales unit at the head offi ce, and have accumulated advanced solution know-how. By spreading this know-how throughout sales branches, we are able to identify the needs of even more customers and solve their problems. In addition, our capability to propose capital strategy solutions has improved through strengthening relationships with funds, and our market presence has been steadily growing. Furthermore, with suffi cient capital and our distribution capabilities utilizing regional bank networks, we are able to handle loans of tens of billions of yen, and have established a unique position in which we can address the challenges of not only middle and small caps but also customers at all stages. In addition to these strengths, LBO loans, a type of M&A fi nancing, have been growing strongly against the backdrop of the Tokyo Stock Exchange's request for “management that is conscious of the costs of capital and stock prices,” as well as growing need for business succession among small & medium sized businesses. We will continue to work to expand high-value-added businesses through providing advanced strategic solutions that contribute to our customers’ management strategies.

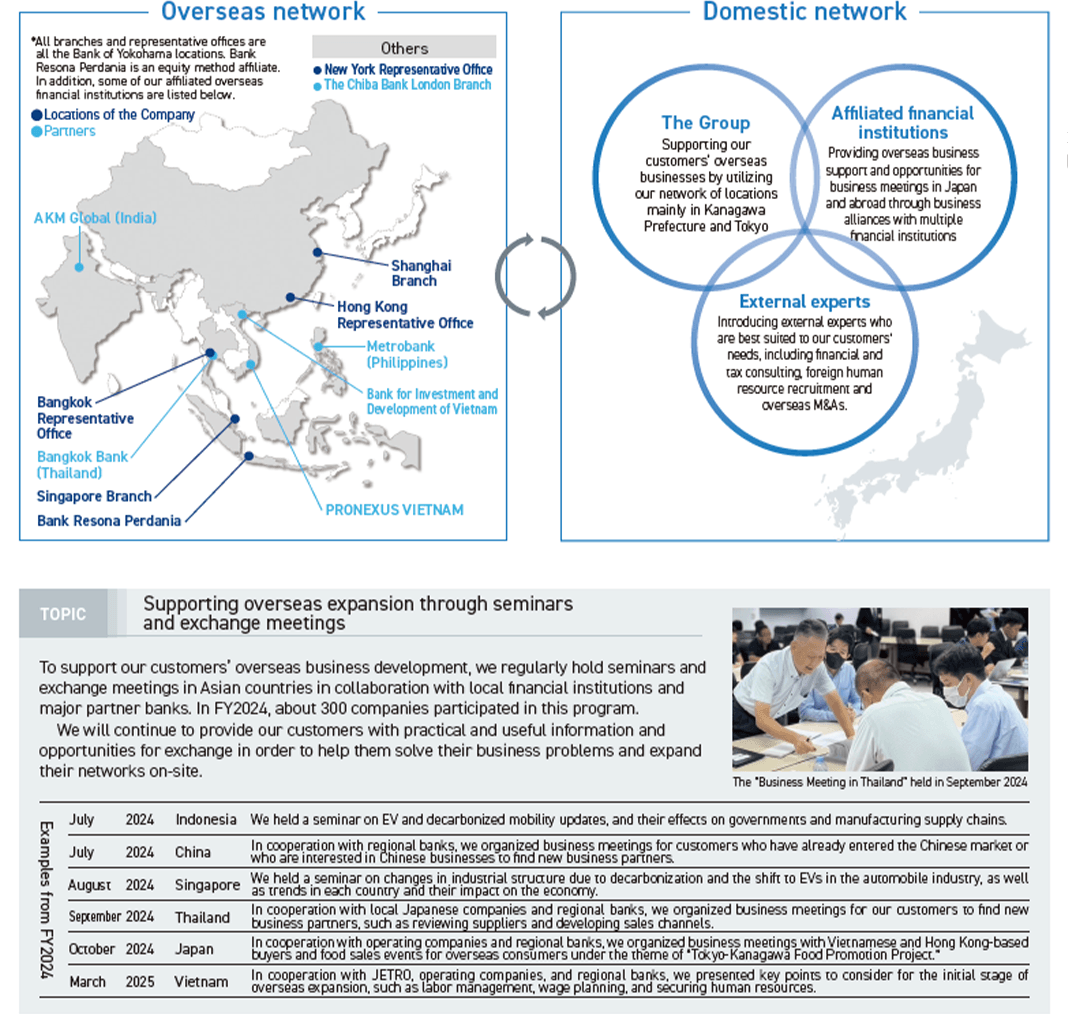

Strengthen the solution business by utilizing the overseas offices

The Group provides comprehensive support for its customers’ business development in Japan and overseas. In our overseas business, we leverage our extensive overseas network centered on the growing Asian region, our high level of expertise and our domestic network to provide tailored services to customers seeking to expand globally and to support their overseas expansion and business expansion.

Specifi cally, we provide tailored support, such as providing local information, assisting with the establishment of local corporations, developing business transactions, fi nancing, and hedging foreign exchange risk. In addition, we provide optimal solutions, such as on-site surveys, business meetings, seminars, and cross-border loans, in accordance with each stage of our customers’ overseas businesses (initial expansion stage, full-scale operation stage, and restructuring stage), as well as focus on foreign exchangerelated services, such as money transfers, foreign currency deposits, letter of credit transactions, foreign exchange contracts, and derivative products to respond to the diverse needs of our clients.

In recent years, non-Japanese businesses such as corporate loans and structured fi nance have expanded, and we are developing highly specialized solutions to meet diverse needs.

In the future, we will promote initiatives to provide comprehensive support for customers' overseas businesses by supporting them from the beginning and combining fi nance, foreign exchange and solutions.

Initiatives

① Increase in lending to customers’ overseas subsidiaries

- Overseas branch loans

- Cross-border loans

- Standby credit

② Borderless development of solution business

- Expansion support

- M&A

- Sales channel expansion

③ Strengthening initiatives for overseas operations

- Portfolio Diversification (Country/Industry)

- Strengthening sourcing capabilities (use ofoverseas offices)

- Expansion of initiative target areas (non-Japanese high credit areas)

Higashi-Nippon Bank’s Initiatives (Strategy to Be a Total Partner for Small and Medium-sized Enterprises)

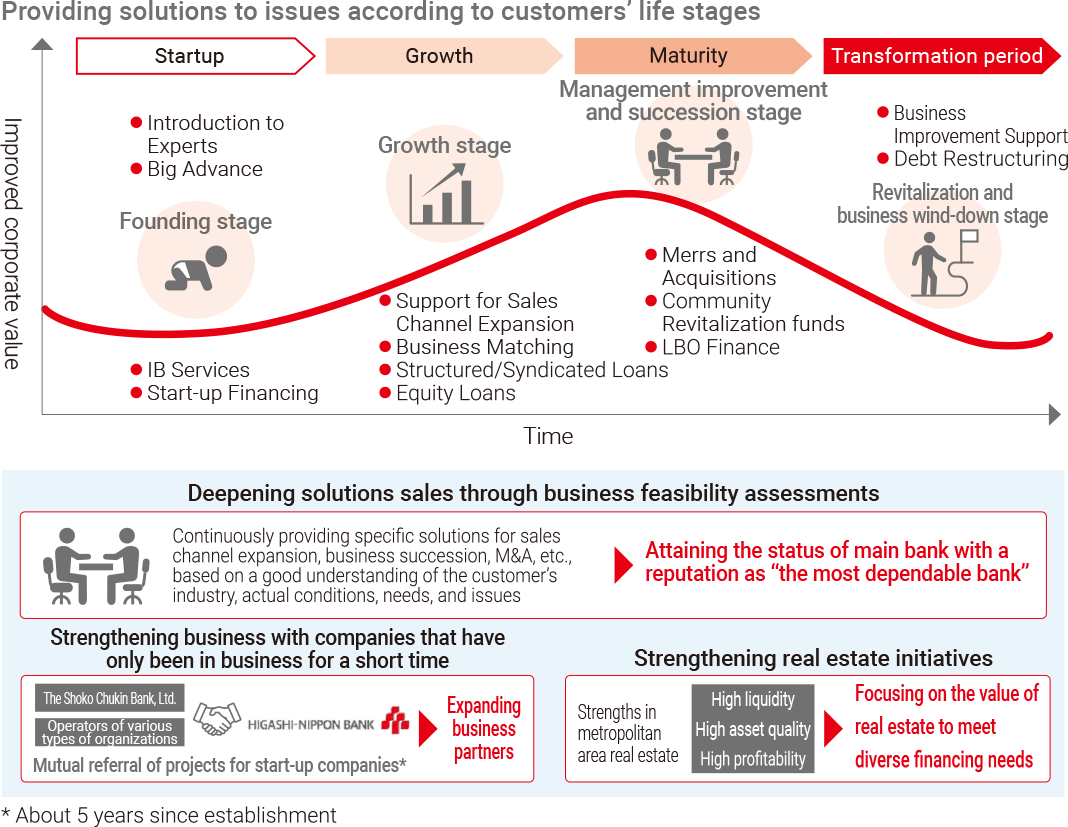

Aiming to be a “total partner for small and medium-sized enterprises,” we will provide optimal solutions for each customer’s lifecycle by providing sympathetic “face to face” service.

In addition, by increasing branch efficiency, consolidating operations at headquarters, and concentrating management resources in the 23 wards of Tokyo, we will achieve an operating structure that achieves overwhelming efficiency as a regional bank in the 23 wards of Tokyo.

Strengthening support f or each stage of corporate life

Through business feasibility assessments, we will better understand the needs and issues of our cust omers and enhance our solution offerings for all lifecycle issues, thereby contributing to the sustainable enhancement of their corpor ate value.

Establishment of an efficient sales structure

We will establish an efficient sales structure in the 23 wards of Tokyo by increasing the number of sales personnel in this area and centralizing the administrative work of sales branches into head office.

THE KANAGAWA BANK’s Initiatives

Expected effects of business integration

Strengthening the solution business at THE KANAGAWA BANK

Sharing in Bank of Yokohama’s knowledge and expertise and providing Group functions to further resolve customer issues

THE KANAGAWA BANK is benefiting from the shared insights and expertise of the Bank of Yokohama in sustainable finance and other areas, which help its customers solve their problems. By fully drawing from the Group’s capabilities, we will strengthen our solution business to meet the diversifying needs of our customers.

Key measure

- Accelerating the exchange of human resources between the two banks

- Jointly holding job class/assignment-based training programs

Expansion of transaction base as a regional financial institution

Expanding opportunities to serve customers in the prefecture

Efficient sales activities for the customer segments in which each company has strengths

The Bank of Yokohama has strengths in providing high value-added solutions that are deeply engaged with management strategies for relatively large companies, while THE KANAGAWA BANK has strengths in providing consulting services to small and medium-sized companies to support their core businesses, startups, and second foundings. In addition to expanding the customer base in Kanagawa Prefecture by bringing the two banks, which have few competitive relationships and complement each other, into the same group, the two banks will strengthen face-to-face sales in areas where each bank has strengths, and THE KANAGAWA BANK use of the Bank of Yokohama’s digital channel functions to expand customer contact points will be promoted.

Key measure

- Co-hosting seminars for corporate and individual clients

- Deepening of solution sales through collaboration with the Bank of Yokohama’s affiliated companies

Strengthening the management foundation through improved management efficiency

Improving operational efficiency and creating human resources through DX

We will improve management efficiency by consolidating capital, human resources digital tools, and other management resources and reducing costs through effective utilization of functions, thereby further strengthening the management foundation of the group as a whole.

Key measure

- Introduced the Guarantee Association Loan Web Application Service in collaboration with the Bank of Yokohama and the Higashi-Nippon Bank