Solving the Problems of an Aging Society with a Declining Birthrate

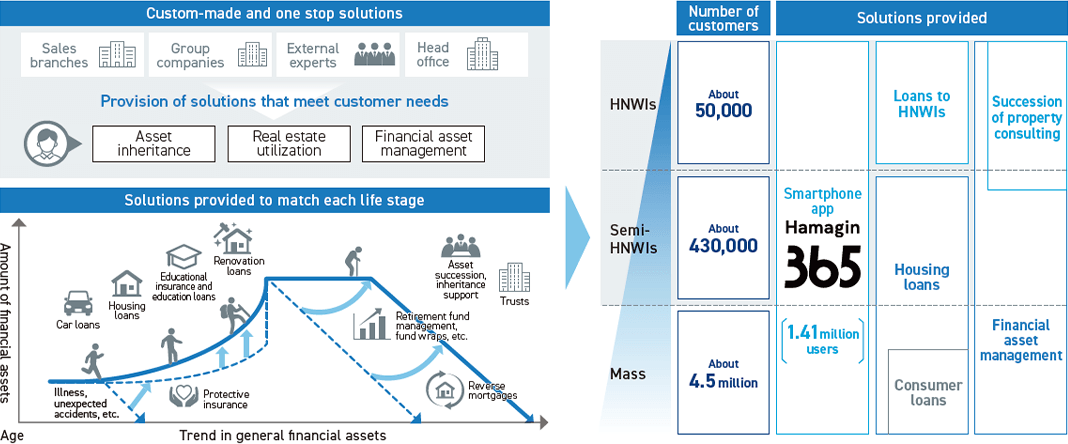

As a lifelong partner, we support our customers’ affluent lifestyles in the age of centenarians by providing optimal solutions for each stage of their lives.

Providing solutions based on consultation service

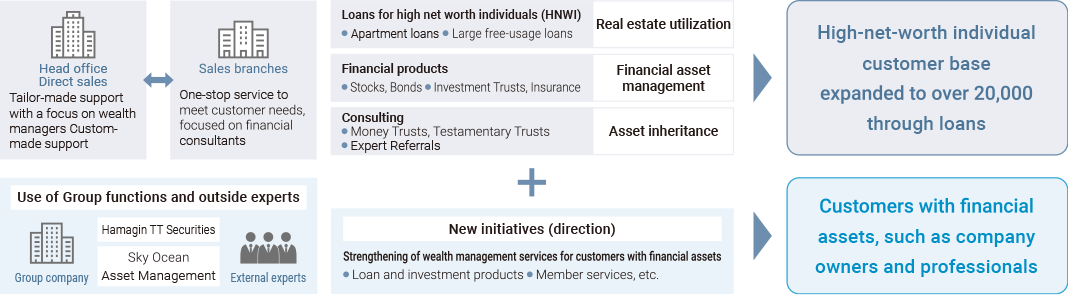

With a broad menu of fi nancial products such as banking, securities, insurance, and trusts, we provide optimal solutions tailored to customers’ life stages. Centered on HNWI customers acquired through loan transactions, we provide custom-made and one-stop solutions by utilizing direct sales at head offi ce, Group functions, external experts, etc. We are also working to strengthen our wealth management services to provide comprehensive solutions to customers with fi nancial assets.

Providing tailor-made, one-stop solutions

We provide tailor-made, one-stop solutions to affluent customers. These have expanded through loan transactions, by utilizing direct sales at head office, group functions, and outside experts.

We also work to provide comprehensive solutions to customers with financial assets by strengthening our wealth management services.

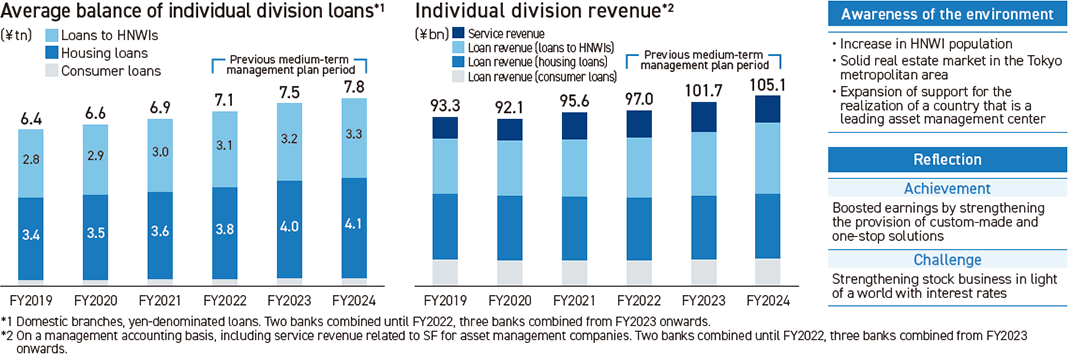

Achievements and recognition of issues of the previous medium-term management plan

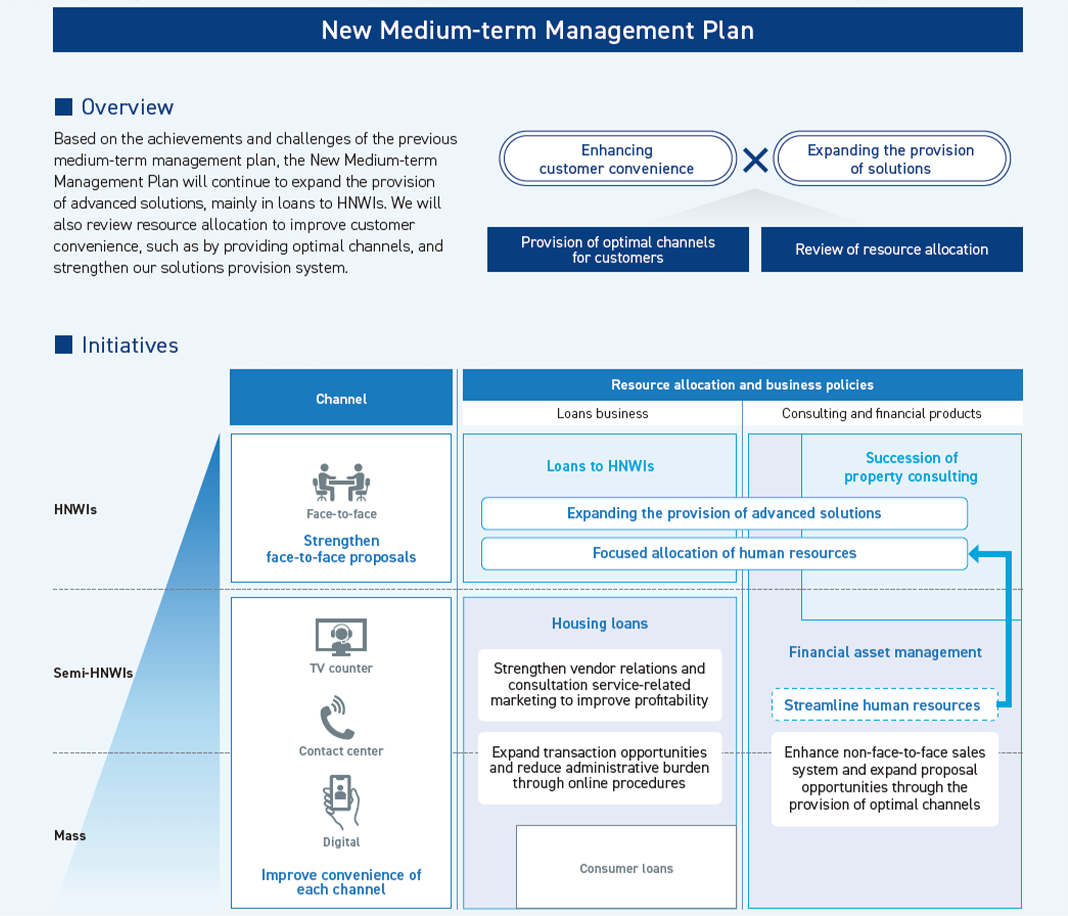

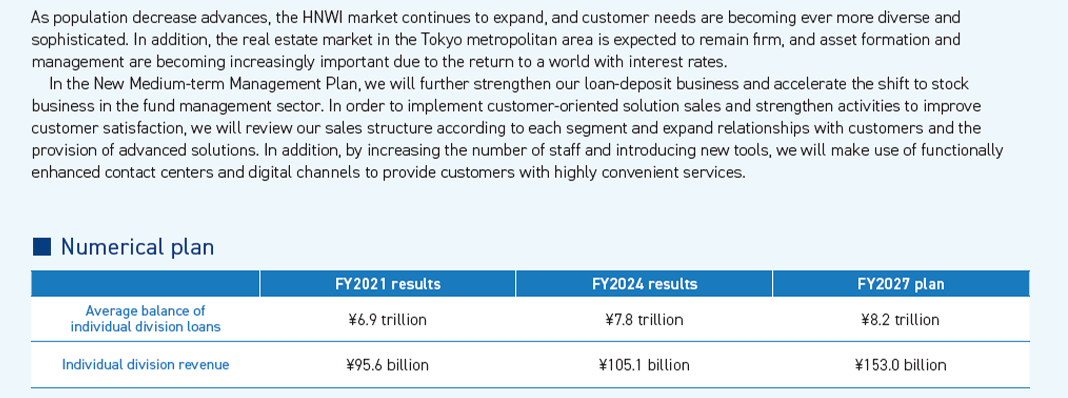

By strengthening the provision of custom-made and one-stop solutions, we have accumulated loans to HNWIs and expanded individual division revenue. On the other hand, in light of a world with interest rates, we recognize the further strengthening of stock business as a challenge.

Initiatives for loans to HNWIs

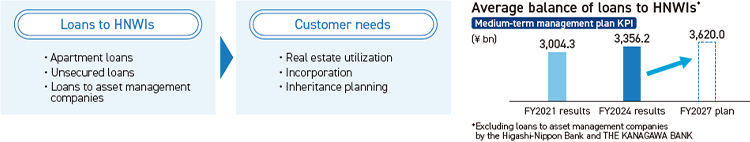

We are working to strengthen loans to HNWIs in order to meet the needs for real estate utilization and inheritance planning, mainly for customers who own real estate. In the New Medium-term Management Plan, we will further strengthen our relationships with customers and real estate agents and focus on developing human resources to build a solid sales base and a strong solutions provision system and expand the balance of loans to HNWIs.

By building relationships with the next generation as well as strengthening relationships with the borrowers, we will establish relationships that ensure continued transactions, and by deepening our relationships with real estate agents, we will develop a relationship of trust that enables them to stably consult with us on projects.

For human resource development, we will provide training at head offi ce for about two months with the aim of developing human resources as quickly as possible. Even after the training is completed, managers and other personnel will continue to follow up to raise the profi ciency level, and thereby the entire organization will work to increase the number of personnel responsible for loans to HNWIs.

Initiatives for succession of property consulting

In succession of property consulting, we are strengthening our activities to bring to light the various potential needs of our customers and provide them with optimal consultation services to solve their problems. In the New Medium-term Management Plan, we will deepen our relationships with customers, mainly HNWIs, by expanding our points of contact. We will also identify their needs by listening to their family structures, financial backgrounds, and succession policies. At the same time, we will actively utilize our network with external experts to expand the range of solutions we offer. In particular, we will strengthen consultation services, which will lead to proposal-based loans against the backdrop of inheritance planning and succession of property such as real estate, etc.

Housing loans

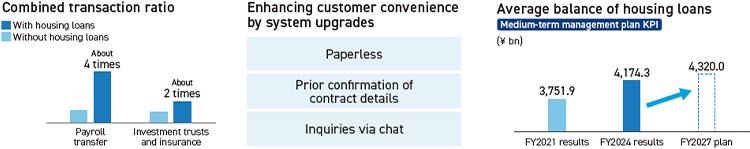

As housing loans are gateway products that lead to combined transactions such as settlement, we will strengthen our efforts to expand comprehensive transactions and strengthen the customer base while taking into account profi tability.

By introducing a new support system for housing loan business, we aim to enhance points of contact by realizing online communication with customers and strive for the expansion of the balance of housing loans and the improvement of customers’ lifetime value (LTV).

In addition, we will use the time created by reducing the administrative burden through the introduction of the new system to focus on consulting sales, such as insurance and asset formation support, and strengthening relationships with real estate agents.

Financial asset management

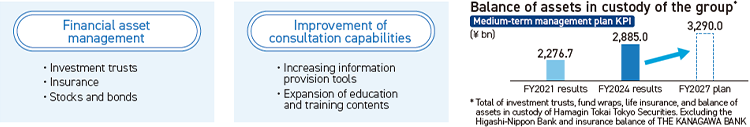

In order to support each customer’s asset formation and management in the medium- to long-term, we have adopted the concept of goal-based approach and are implementing optimal portfolio proposals that respond to customer needs. By continuing to being close to customers after signing contracts and providing appropriate information in a timely manner, we are working to create an environment where customers can consult us with confi dence. In addition to expanding opportunities to provide information including seminars for customers, we will strive for enhancing customer convenience by providing various channels such as websites and apps, contact centers, and online consultations. We will also realize high-quality consultation services to increase customer satisfaction.

In addition, through training and study sessions, as well as encouraging employees to acquire qualifi cations, we are actively engaged in developing human resources with advanced expertise and skills suitable for a fi nancial professional.

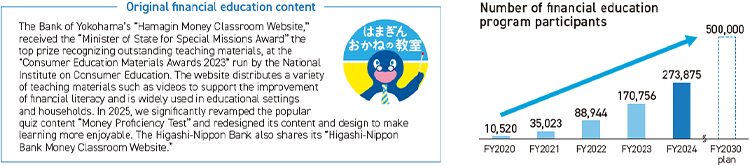

Initiatives for Financial Education

We see financial education as a key responsibility of our Group as we strive to contribute to the sustainable growth and further development of the region and the healthy upbringing of the youth who will lead the next generation. Our banks offer a range of original, branded financial education programs for a wide audience in the community, from children to adults. These include “Hamagin Money Classroom”, “Higashi-Nippon Bank Money Classroom”, and “Kanagin Finance Classroom”.

Website for supporting digitalization

issions Award”, the top prize recognizing outstanding teaching materials, at the “Consumer Education Materials Awards 2023” run by the National Institute on Consumer Education. The Bank of Yokohama also offers an online work experience program developed with TOKYO SHOSEKI CO., LTD. In addition, the Higashi-Nippon Bank shares its “Higashi-Nippon Bank Money Classroom Website”.

The Concept of Financial Education

Financial education is not only the study of knowledge about money, but also the nurturing of the ability to contribute to a richer life and society by means of money. The Group has positioned “the value of money”, “how to use money”, “earning money” and “money management” as “basic money education”, and has built a program in which students learn about these topics and then learn about financial literacy, including asset building and financial struggles.

Cooperation and collaboration with the Tokyo Stock Exchange and local governments

In FY2023, the Bank of Yokohama started a partnership with Tokyo Stock Exchange, Inc., which leads to the enhancement of fi nancial literacy on asset formation and asset management in a neutral way. In FY2024, the Bank developed a program for employees of the Yokohama National University, Yokohama City University, and Yokohama City that combines the Bank's original method, “basic money education,” which was developed as an education program to be taught before learning asset formation, with the Bank's “concepts of asset formation.” A similar program was also implemented jointly with the Japan Financial Literacy and Education Corporation (J-FLEC).

The Higashi-Nippon Bank joined the Tokyo Metropolitan Government’s “Entrepreneurship Education Program for Elementary and Junior High Schools,” providing support for creating an environment, which makes entrepreneurship more accessible and a future career option. THE KANAGAWA BANK takes part in the Yokohama Board of Education’s “Kids Adventure College.” It teaches elementary school students in Yokohama about the role of banks and related themes like the fl ow and importance of money.

Agreement for collaboration on fi nancial education with Yokohama National University

In March 2024, the Bank of Yokohama and Yokohama National University signed an agreement for collaboration on fi nancial education. The University is an educational research institute and teacher training institution with a wide range of education faculties, including the College of Education, affi liated elementary, junior high and special needs schools, and Graduate School of Education for teachers in Kanagawa Prefecture. Through this agreement, efforts are being made to standardize fi nancial education at affi liated schools, etc., and to develop leaders in fi nancial education at the College of Education and Graduate School of Education and to promote the dissemination, development, and improvement of fi nancial education programs.

In FY2024, we provided training for future leaders at the College of Education and the Graduate School of Education and taught 22 classes for 2,400 students from the affi liated elementary school to the graduate school. The classes were published in the case studies of the affi liated junior high school. In FY2025, we gave a lecture at the 77th Meeting of the Japan Society of Home Economics, which was held at the same university and our initiatives are expanding through collaboration.

Fostering future leaders in financial education

The Bank of Yokohama works to train teachers and university students in education departments by offering classes on the “outlines and importance of fi nancial education” as well as classes using its original “basic money education” method. In this way, it aims to foster future leaders in fi nancial education in schools. At a seminar for teachers hosted by the Kanagawa Prefectural Board of Education, home economics teachers from 146 public schools attended. There were also seminars for teachers at public elementary schools in the Nishi ward of Yokohama City and the Kanagawa Prefectural Association of Private Junior and Senior High Schools, as well as lectures at Yokohama National University. After the seminars, teachers who attended have been applying fi nancial education in their schools, spreading these efforts throughout the community.

As a leader in home education, we also focus on initiatives for parents and guardians. In FY2024, we provided classes for parents and children at events such as a visiting lecture at the Affi liated Elementary School of Yokohama National University, an event for Kanagawa Prefectural Police personnel, a Toin Fun Hands-on Class, and a J-FLEC co-sponsored event.