Forming a Digital Society

For our vision of being “a solution company rooted in communities and selected as a partner to walk together”, we will contribute to the sustainable development of local communities by delivering new experiences and value to local customers through financial and non-financial services using digital technology, and by supporting business growth by providing advanced digital solutions.

Digital Strategy

In the rapidly advancing digital society, all kinds of information is converted into data and connected, and people enjoy various conveniences by utilizing this data.

The Group will make the best use of this digital society and provide optimal proposals based on one-to-one communication with customers. In addition, we will create new customer experiences by improving customer convenience through the advancement of solution services and the promotion of cashless payments, will support digitalization, and will continue to develop human resources to provide these services.

Promotion Status of Digital Transformation

Initiatives by the Bank of Yokohama

| Individual customers |

|

|

|---|---|---|

| Corporate customers |

|

|

Initiatives by Higashi-Nippon Bank

Our Corporate Portal (Business Connect) was introduced in December 2022. In addition, we are also promoting the use of RPA to improve operational efficiency within the bank and are promoting internet banking (IB) to our customers.

Digital transformation of branch operations

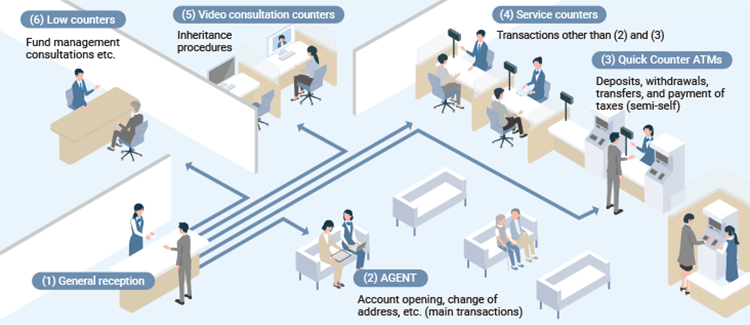

Transition to next-generation branches

As of March 31, 2024, the Bank of Yokohama has installed “Semi-self-service Counters” at 77 branches, where customers can use “Quick Counter ATMs” to make deposits or withdrawals using their cash cards with the support of Yokohama Bank staff. In order to further improve the efficiency of operations at branches and to increase convenience for customers, we will continue to move forward with the introduction of this teller window, as well as the transition to next-generation branches, including the establishment of TV teller windows and the upgrading of the “AGENT” next-generation sales branch tablet terminal.

With “AGENT” we have completed development for major transactions (account opening, change of address, inheritance acceptance,etc.) and are now undertaking in-house development, focusing on functional improvements and operations with high transaction volume.

In addition, inheritance procedures via video consultation, which began at five branches in February 2023, are being gradually expanded, and we are working to provide detailed services through the specialist departments at head office.

Introduction of Branch Visit Reservation Service

In April 2023, the Bank of Yokohama introduced the “Visit Reservation Service” to all its branches. This service allows customers to reserve a date and time to come in for transactions such as opening an ordinary deposit account, changing personal information and registered seal details, etc. In principle, customers can make such reservations 24 hours a day, 365 days a year, via the Bank of Yokohama website using a smartphone or computer. Customers with reservations are given priority when they visit the branch. Through the introduction of this service, the Bank of Yokohama aims to reduce waiting times when customers visit its branches.

Expansion of non-face-to-face transactions

The Bank of Yokohama has been expanding non-face-to-face transactions focusing on change of address, payment of taxes and various fees, transfers, and account openings. Starting from March 2024, procedures for notification of inheritance have become available through the website.

Digital transformation of non-face-to-face services

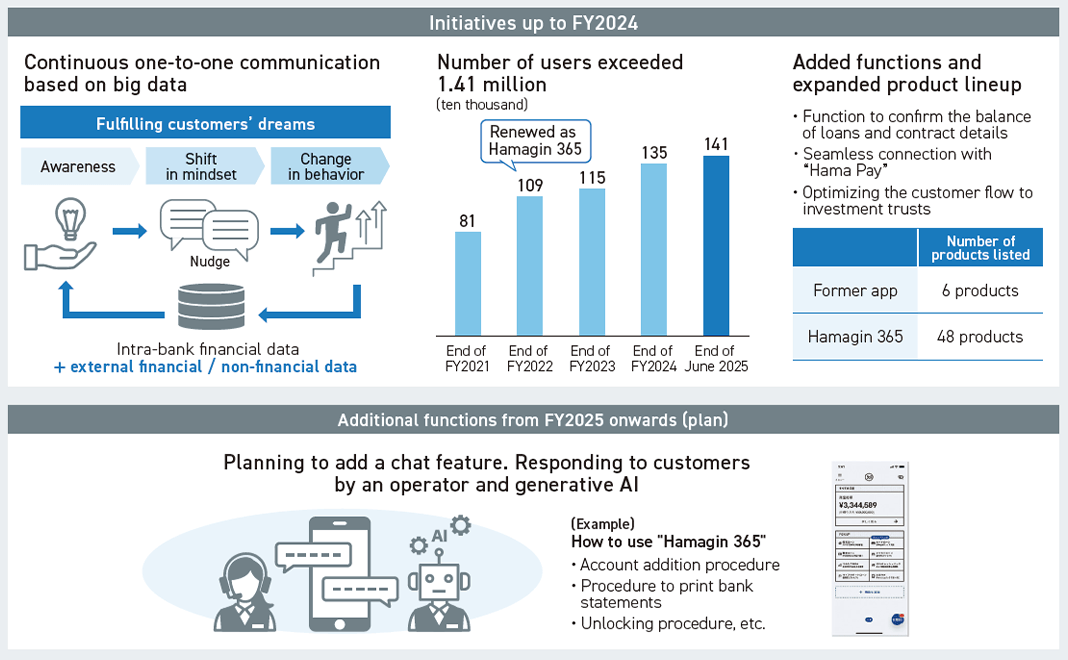

Increase customer touchpoints by improving the convenience of the smartphone app "Hamagin 365"

"Hamagin 365," a smartphone app developed by the Bank of Yokohama for individual customers, strengthened its presence as a main channel and exceeded 1.41 million users as of the end of June 2025. In FY2024, we enhanced our banking functions, such as checking the balance and contract details of housing loans and other various loans, and seamless connection with the settlement app "Hama Pay." In addition, the customer fl ow to investment trusts transactions and household account app were optimized to pursue further convenience. In FY2025 onwards, we plan to implement a time deposit service limited to Hamagin 365 and a chat function that makes use of AI so that customers can easily consult with us. We will continue to position “Hamagin 365” as an important touchpoint for our customers and provide cutting-edge solutions while pursuing customer-oriented services.

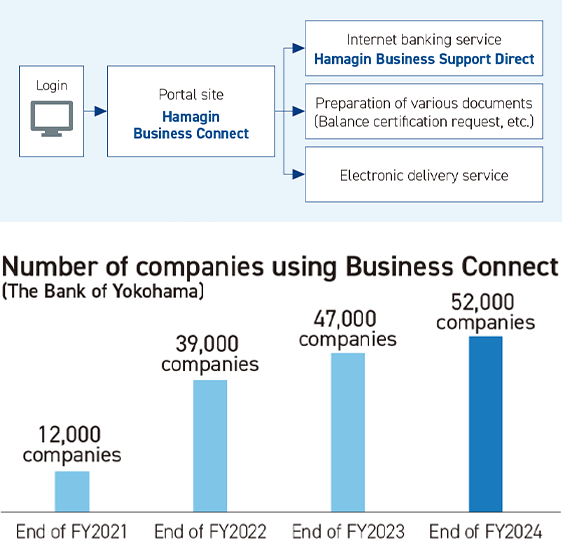

Providing the business portal “Hamagin Business Connect”

The Bank of Yokohama provides “Hamagin Business Connect,” a membership portal site for corporate customers, as a non-face-to-face service aimed at enhancing customer convenience and strengthening digital communication. As of the end of March 2025, we have 52,000 corporate customers as a result of integrating the log-in function into Internet banking, completion of various transactions online, and providing information to customers through the “Notification” function.

We will continue to expand our comprehensive business through enhancing functions.

The Higashi-Nippon Bank also began offering Higashi-Nippon Business Connect from December 2022.

Promote cashless access in the community

Through its smartphone payment service HamaPay, the Bank of Yokohama joined a new payment infrastructure for high-frequency small-lot payments Cotra Money Transfer from October 2022, and started offering the Cotra Money Transfer Service, a fee-free service for remittances of ¥100,000 or less to personal accounts.

In addition, starting in April 2023, HamaPay began handling Cotra Pay Tax, which allows payment of property tax, automobile tax, and other taxes in “Pay Bills”.

Digital Transformation with Customers and Local Communities

Digitalization support

The Bank of Yokohama is supporting the improvement of customer operation efficiency and productivity through digital means, and strengthening its support for digitalization, including compliance with legal systems.

We understand our customers’ digitalization issues and propose and provide optimal solutions in collaboration with about 60 digital companies, including information sharing with head office, in group function collaboration, information processing services, and cloud-based labor and human resource systems.

In addition to providing business matching services as well as consultation services via the Hamagin Research Institute, which leverages the group functions to tackle multi-faceted challenges related to DX, the Bank itself offers a “deployment support service” for customers deploying cloud-based systems as part of its focus on helping them resolve management issues.

An example of AI utilization in banking operations supporting productivity improvement

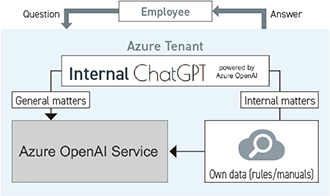

Use of generative AI “Internal ChatGPT” in operations

In November 2023, the Bank of Yokohama and the Higashi-Nippon Bank launched Internal ChatGPT, a GenAI-driven information analytics platform for the exclusive use of employees.

Internal ChatGPT augments the usual ChatGPT functionality by allowing internal information such as the various rules and manuals of the two banks to be referenced.

It makes tasks performed by employees, such as document preparation, more efficient*, allowing them to concentrate on more demanding or new tasks.

- *It is said that tasks such as general document preparation take 37% less time when ChatGPT is used.

Toward implementation of AI to support the preparation of loan approval documents

In November 2024, the Bank of Yokohama implemented a pilot project to use generative AI in the preparation of approval documents for loan screening. The results confirmed its effectiveness in terms of improving employee work efficiency and screening skills. It is expected that using generative AI to assist in preparing loan approval documents will improve operational efficiency by up to 19,500 hours per year. It also proved effective in clarifying points lacking in customer hearings regarding the screening items required for credit decisions.

Employees are able to gain “awareness” of what kind of information to obtain from customers through loan screening using generative AI, and this “awareness” is expected to effectively improve employees' screening skills. We will organize the points and issues identified in this pilot project and work toward implementation. By implementing this system, we will meet the diverse needs of our customers and realize more productive ways of working to contribute to the sustainable development of local communities.

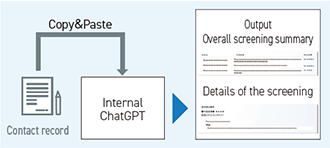

Increased efficiency in verifying customer contact records using generative AI

The Bank of Yokohama utilized “Internal ChatGPT” to assist inexperienced managers in verifying customer contact records for sales of investment trusts and other products and to reduce the workload, thereby increasing operational efficiency. This system allowed us to improve operational efficiency and reduce about 20% of the conventional workload. We will further refine our efforts to strengthen relationships with customers by allocating the time saved to external liaison activities.

Strengthening the IT digital infrastructure supporting productivity improvement

Intranet revamp

The Bank of Yokohama and the Higashi-Nippon Bank are actively revamping and optimizing their IT digital infrastructure to realize “improving productivity,” one of the Priority Strategies of the medium-term management plan. As part of this effort, we have completely revamped our intranet to improve the efficiency of internal operations. The new intranet greatly improves the capabilities of internal terminals, increasing operational speeds and providing stress-free operation. This has improved work efficiency of each employee and created a highly productive work environment. We have also introduced SASE (Secure Access Service Edge) as a new security measure. With this latest security framework, we are expanding the possibility of business reform through the use of cloud services while ensuring high security both inside and outside the banks. Through these initiatives, we will strive to improve productivity of the entire Group by making the IT digital infrastructure a strong foundation for productivity improvement and creating an environment in which employees can focus on higher value-added work.

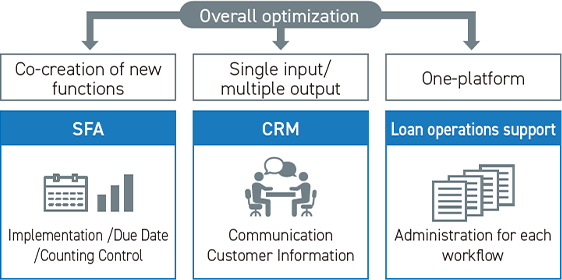

Introduction of the Sales Loan Support System

In January 2024, the Bank of Yokohama and the Higashi-Nippon Bank introduced the Sales Loan Support System, a next generation SFA/CRM/ loan screening system that enabled them to reform their external liaison operations. This system has been used jointly by fi ve MEJAR banks since May 2025. With the introduction of this system, we expect to achieve efficiency gains in many operations. By allocating the time thus saved to liaison activities, we will further refine our efforts to strengthen relationships with customers.

Strengthening the system to introduce and expand the use of AI to improve productivity

In order to promote productivity improvement, the Bank of Yokohama actively utilizes AI technology and aims to maximize its effects. To this end, we established the Innovation Promotion Group within the IT Solutions Department in April 2025. This group is responsible for developing a governance system to accelerate the use of AI as well as developing and operating AI technologies to improve the efficiency of banking operations, thereby contributing to business process innovation and competitiveness. Through this initiative, we will further strengthen the foundation that supports sustainable growth.

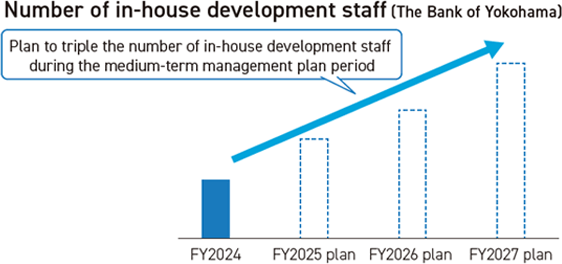

Accelerating in-house system development

The Bank of Yokohama is strengthening its in-house system development structure to add new functions to “Hamagin 365” and also the “AGENT” tablet terminal for sales branches, as well as to expand electronic banking services for customers. The traditional method of outsourcing development to an external systems company made it difficult to respond quickly to diverse needs of customers and rapidly evolving digital technologies. By promoting in-house development, we will be able to increase our development speed and deliver highly convenient services to customers more quickly. In this way, we aim to further improve customer satisfaction by providing better services.

Human resources

The Bank of Yokohama develops practical and flexible educational programs to improve the AI literacy of all employees and realize the evolution of the organization for the digital age. In order to create environments in which employees can learn the basics of AI and how to use it in their work in a way that is easy for them to understand, we provide educational content through video streaming and encourage employees to learn from each other through regional study meetings. In addition, by appointing a person in charge of promoting generative AI in each head office division and holding regular meetings on generative AI utilization, we support sharing examples of AI utilization on the ground and the creation of new ideas. Furthermore, we are also focusing on developing specialized talents and promoting the recruitment and development of highly specialized talent such as project managers, cybersecurity experts, and AI developers. As a result, we are accelerating the planning and development of AI solutions that will directly lead to more efficient banking operations and improved customer service. Through these initiatives, we aim to create an organization in which all employees can properly understand and utilize AI and will improve productivity and provide new value to our customers by further expanding IT and digital specialist workforce.