Conserving and Preserving the Environment(Initiatives for TCFD/TNFD recommendations)

The conservation and preservation of the environment is an important responsibility for the Group, and we recognize that climate change and nature are closely interrelated. In December 2019, the Group endorsed the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD)*1, and in February 2024, we participated in the Task Force on Nature-related Financial Disclosures (TNFD)*2 Forum. Since then, the Group has been disclosing its views and approaches on climate change and nature in an integrated manner based on the respective frameworks.

- *1Task Force on Climate-Related Financial Disclosures: A private-sector-led task force established by the Financial Stability Board (FSB) in December 2015 to encourage companies to disclose climate-related information

- *2Task Force on Nature-related Financial Disclosures: A private-sector-led initiative launched in June 2021 to encourage companies to disclose nature-related information

Governance

Risk management

Within the Group, each subsidiary has set up a risk control department as well as a risk management department for each type of risk, thereby identifying, evaluating, and managing risks. The Risk Management Department at the holding company comprehensively manages risks for the entire Group, and an officer in charge of risk, who is separate from the General Manager of the Audit Department, regularly reports on the risk status to the President and Representative Director and the Board of Directors. In addition, matters related to sustainability are discussed separately by the Sustainability Committee, and the details of the discussions are reported to Board of Directors.

Furthermore, the Group has identified and evaluated sustainability-related opportunities by materiality in the new medium-term management plan (FY2025 to FY2027), set KPIs, and is implementing specific initiatives. Progress on KPIs is regularly reported to the Board of Directors, with the Board of Directors following up as necessary.

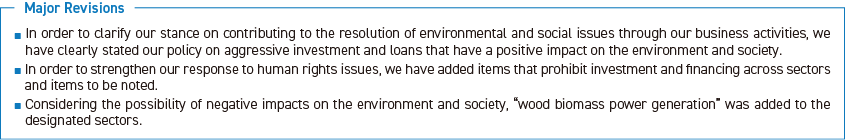

Top risks

We assess risks that could greatly affect the Group’s operations, judging their significance by impact and likelihood. The Board of Directors then identifies the most critical risks as “top risks”. For top risks, we set Key Risk Indicators (KRIs) and monitor them continuously to spot early warning signs. We have also arranged systems to respond swiftly if a risk becomes evident. Risks related to sustainability such as climate change are also positioned as “top risks.”We will continue to work to build a system that can be managed within the framework of comprehensive risk management.

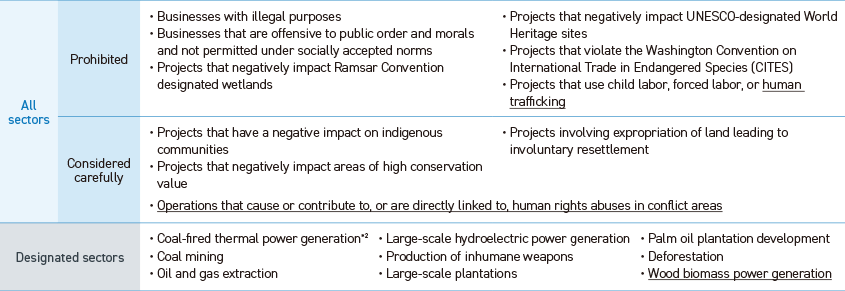

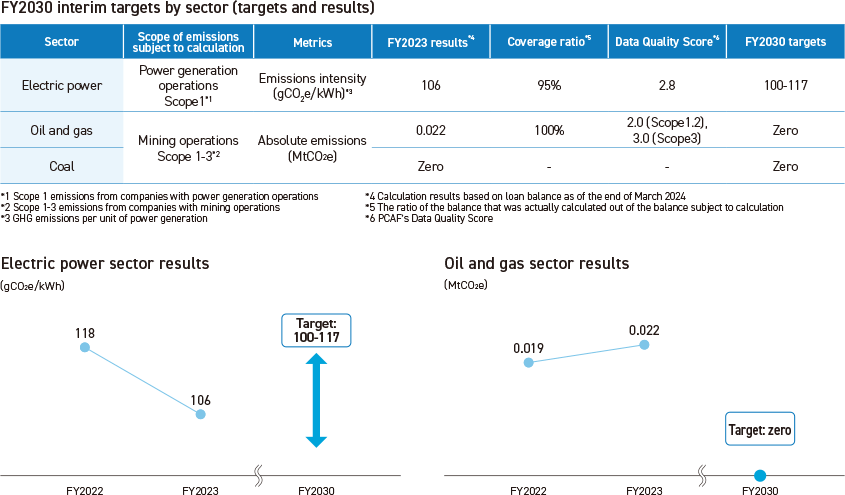

Sector Policy

The Group has established a Sector Policy regarding investments and financing that take environmental and social considerations into account. Through the sector policy, we are working to reduce and avoid negative environmental and social impacts by identifying businesses in sectors where we ban or restrict investment and lending, and also having guidelines for certain sectors, with regard to investments and loans for the use of funds that are highly likely to promote negative impacts.The Group Sustainability Committee regularly discusses the necessity of revisions and reviews the Sector Policy as needed in response to changes in our own business activities and the external environment. The following revisions were made in March 2025.

Sector Policy summary*¹

The Group will actively engage in investments and loans for the use of funds that have a positive impact on the environment and society through transactions. In addition, the Group will strive to reduce or avoid negative impacts on the environment and society by carefully judging transactions in relation to investments and loans for the use of funds that are highly likely to promote negative impacts on the environment and society.

- *1Underlined parts were revised in March 2025.

- *2Reduction of balance for existing investments and loans for coal-fired thermal power generation to zero is scheduled for FY2037.

Strategy Climate change

The Earth’s environment, on which human life and business activity depend, is being altered by climate change. Natural disasters and extreme weather events are becoming more severe, threatening the sustainable development of local communities and businesses. Against this backdrop, efforts towards transitioning to a decarbonized society are advancing rapidly.

In the process of transitioning to a decarbonized society, there are expected to be significant changes in the economy and society,such as stricter policies and regulations in countries throughout the world to achieve carbon neutrality, technological innovation to

mitigate climate change, and changes in the values of consumers and investors as a result of greater interest in climate change. We recognize that these changes will lead to both risks and opportunities for the Group, and thus we are examining the impact that the climate-change-driven transition to a decarbonized society will have on our business, while formulating strategies for responding to climate change in order to handle these risks and opportunities.

①Risk (climate change))

Understanding climate change risks

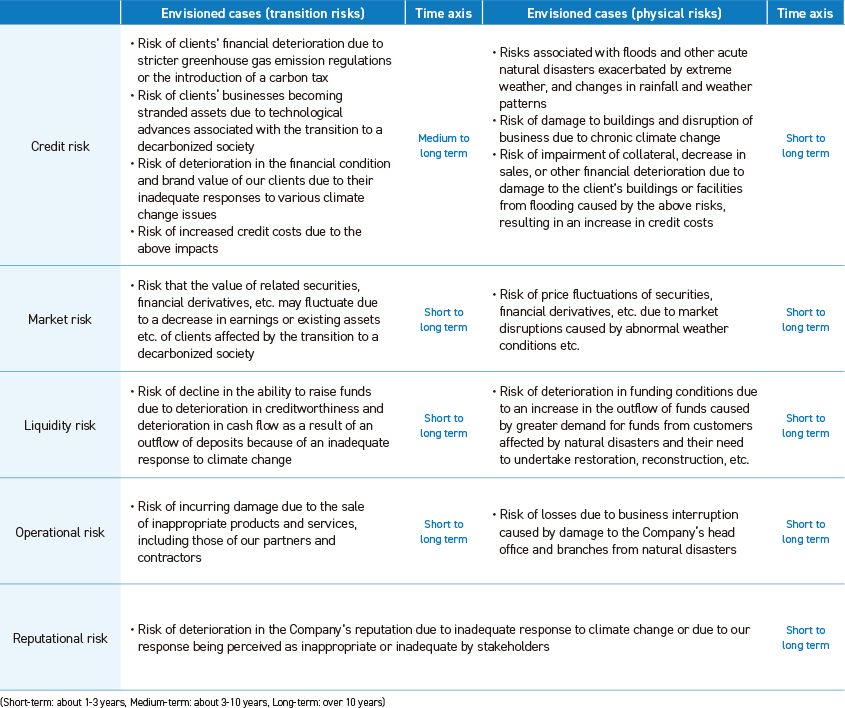

The Group is working to identify and assess two types of risks related to climate change in line with TCFD recommendations ̶ that is, risks associated with the transition to a decarbonized society (transition risks) and risks associated with severe natural disasters and extreme weather events (physical risks). Transition risks and physical risks for each of the risks that the Group categorizes and manages (credit risk, market risk, liquidity risk, operational risk, and reputational risk) are as follows.

Carbon-related assets

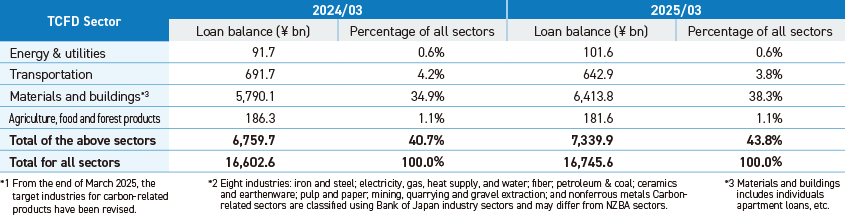

The Group calculates the climate change risk of carbon-related assets*1 based on the TCFD recommendations as one of its efforts to understand loan balance. Calculation results as of the end of March 2025 are as follows.

Since FY2021, separate from carbon-related assets, the Group has identified eight industries as carbon-related sectors*2, industries recognized for significant climate change impacts, and monitors them. The share of the credit balance of the relevant sectors at the end of March 2025 in the total loan balance for all sectors remained at the same level as the previous year, at 2.4%. We will continue to manage risks by monitoring the impact of climate change through our engagement in carbon-related sectors and by increasing the sophistication of our analysis.

Scenario analysis due to climate changes

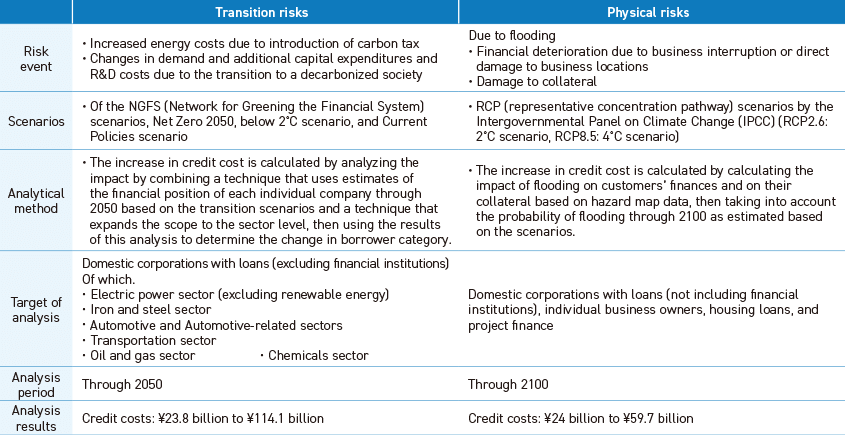

The Group conducts scenario analysis of transition risks and physical risks to understand the degree of impact of climate changes on the investment and loan portfolio. As of March 31, 2025, the results of the analysis were as follows.

For transition risks, we considered the impact on expenditures such as the introduction of a carbon tax, an increase in energy costs due to a change in the composition of power sources, and capital investment due to GHG emissions regulations. In addition, changes in supply and demand due to a decarbonized society are expected to lead to changes in production volumes and prices. Therefore, we analyze the impact on borrowers’ finances from both revenue and expenditure sides. In addition to the electric power, automotive, and automotive-related sectors*1, oil and gas, iron and steel, and transportation sectors*2 conducted in the previous fiscal year, this fiscal year we added the chemical sector. As aresult, most of the sectors that are considered to have a large transition risk for the Group were included in the scope of analyses.

For physical risks, we consider it a high priority to understand the impact of flooding on the investment and loan portfolio because such disasters, which are aggravated by abnormal weather, are a serious acute risk. We are also working to enhance our analysis by refining the location data of each location to be analyzed, mainly in Kanagawa Prefecture and Tokyo, which are the Group's sales bases. Credit costs*3 for transition risks were estimated to be ¥23.8 billion*4 to ¥114.1 billion*5, and credit costs for physical risks were estimated to be ¥24 billion to ¥59.7 billion. We will continue to increase the sophistication of our scenario analysis, and we will work to reduce these risks with decarbonization initiatives through engagement with our customers.

- *1Automotive-related: auto parts, gas stations, etc.

- *2Transportation sector: Marine transportation, air transportation, railway transportation, trucking services, etc.

- *3Calculated based on the difference between the Current Policies scenario, in which the current climate change policies are assumed to be continued, and the scenario in which stricter climate change policies are assumed to be implemented.

- *4Difference from the Below 2° C scenario, which aims to limit global warming to less than 2° C (Below 2° C scenario: ¥126 billion - Current Policies scenario: ¥102.2 billion)

- *5The difference from the Net Zero 2050 scenario in which the global net zero is achieved by 2050 (Net Zero 2050 scenario: ¥216.3 billion - Current Policies scenario: ¥102.2 billion)

②Opportunities (climate change)

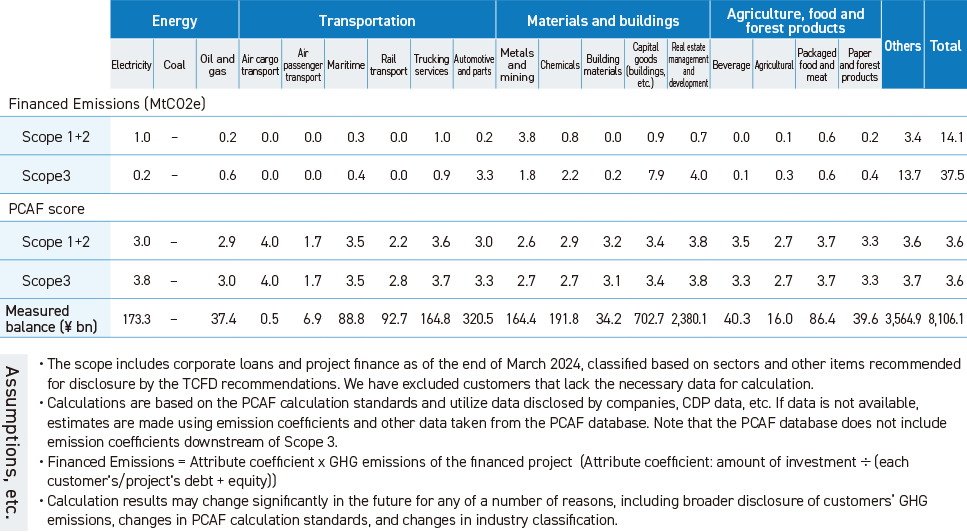

Calculation of GHG emissions in the investment and loan portfolio

As a financial institution, the Group is a member of the Partnership for Carbon Accounting Financials (PCAF), an international initiative that promotes initiatives related to the measurement and disclosure of GHG emissions in investment and loan portfolios, in order to contribute to creating a decarbonized society through the realization of GHG emissions net zero in investment and loan portfolios. In addition, the Group calculates GHG emissions (Financed Emissions) in the investment and loan portfolio, mainly for business loans, based on the standards set forth by the PCAF (hereinafter referred to as the “PCAF Calculation Standards”).

Engagement with customers to achieve net zero GHG emissions for our investment and loan portfolio

Based on the results of the GHG emissions calculations for our investment and loan portfolio, we developed an action plan to help our customers reduce their GHG emissions toward net zero emissions. The details are as follows.

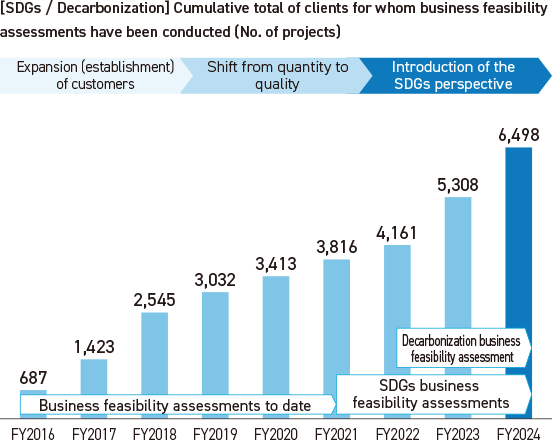

1. All sectors

Since FY2016, we have engaged with our customers to resolve their management issues through business feasibility assessments*1. In FY2022, we introduced SDGs business feasibility assessments*3 and launched decarbonization feasibility assessments that focus on clients’ management issues related to decarbonization. With decarbonization business feasibility assessments, we engage with customers using a newly created Decarbonization Check Sheet to organize and share management issues related to decarbonization, including visualizing GHG emissions. Through this type of engagement, we will continue to provide optimal solutions for our customers’ business challenges and support their sustainability management, including decarbonization.

- *1An initiative to assess a client's business and growth potential without relying on financial data

- *2An initiative to score items related to the SDGs that were newly added to business feasibility assessments and link them to strategy planning and policy proposals

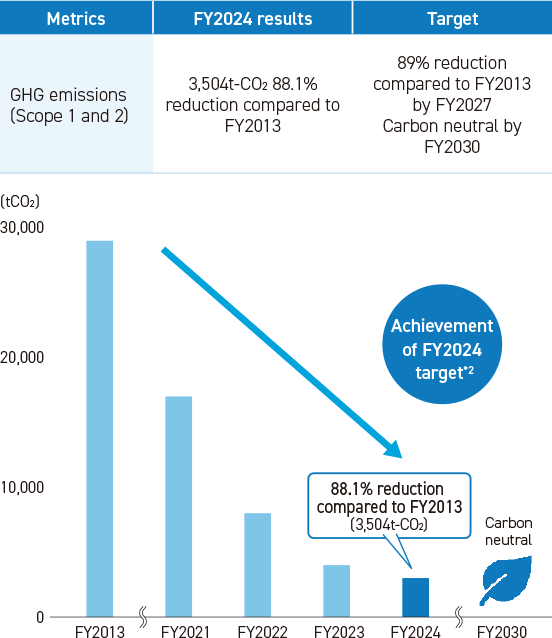

2. Sectors with GHG emission reduction targets set

The electric power, coal, and oil and gas sectors are designated as carbon-intensive sectors*1 in the NZBA*2 and have a high carbon intensity in the Group’s portfolio. Therefore, the Group has selected these three sectors as “sectors with GHG emissions reduction targets” and has set interim targets for FY2030. We will provide support for visualizing and reducing GHG emissions through detailed engagement with individual companies.

- *1Carbon-intensive sectors: electricity, coal, oil and gas, transportation, aluminum,iron and steel, cement, commercial and residential real estate, agriculture

- *2NZBA: Net-Zero Banking Alliance. An international initiative for banks to achieve net zero GHG emissions in their investment and loan portfolios by 2050

3. Priority sectors for engagement

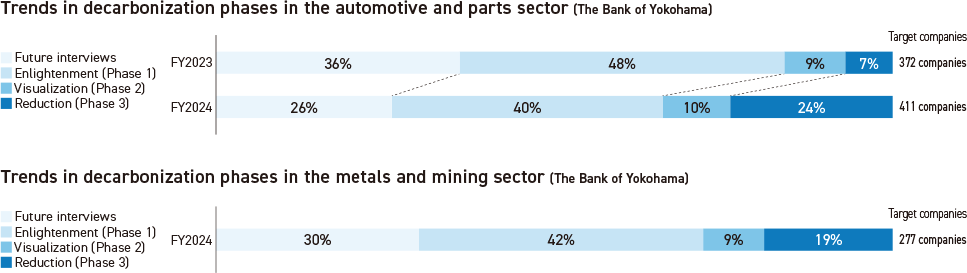

The automotive and parts sector has led the way in analyzing scenarios for transition risks and engaging with the industry’s outlook.

Since the supply chain is extensive and decarbonization efforts are expected to take a long time, we designated it as a priority sector for engagement in FY2022. Furthermore, the metals and mining sector includes the steel industry and the manufacturing of metal products and non-ferrous metal products. Because of the large amount of energy used in the manufacturing of these products, including heat and electricity, it is a sector with comparatively large GHG emissions and was added as a priority sector for engagement in FY2023.

As part of our engagement in these sectors, we conduct interviews with clients about their external environment and initiatives in decarbonized management and work to understand the situation. In FY2024, about 30% of target companies in both sectors identified visualization and reduction of GHG emissions as challenges. We expect growing requests from the companies in our customers’ supply chains to cut carbon. We will therefore continue to provide our customers with the support they need for visualizing GHG emissions and setting reduction targets.

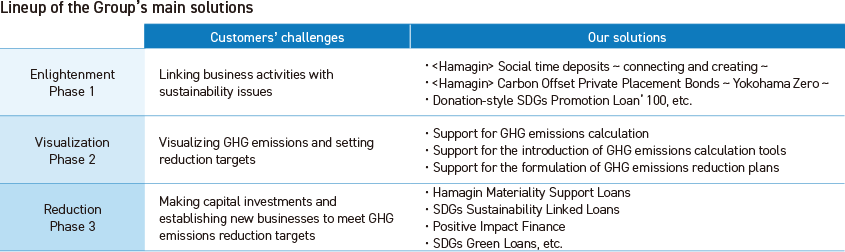

Providing optimal solutions according to the customer’s initiative phase

The Group recognizes that it is important to engage with customers to share the challenges they face in order to reduce transition risks and physical risks and to expand opportunities for growth, to enhance the lineup of solutions that contribute to solving their challenges, and to provide the optimal solutions that meet the needs of each customer. The main types of support provided by the Group according to the customer's phase of decarbonization management are as follows.

Main Sustainable Finance Lineup

Metrics and Targets Climate Change

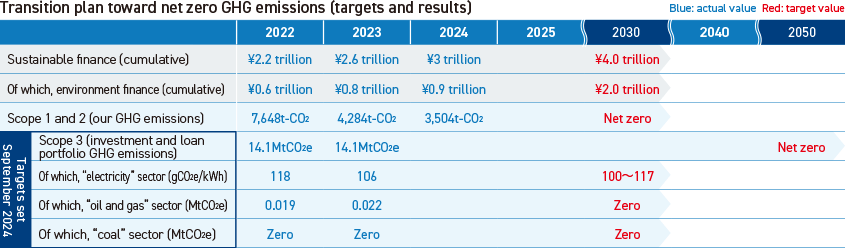

As a community-based financial institution, the Group recognizes its responsibility to play a leading role in decarbonizing local communities.Based on this recognition, we have positioned “conserving and preserving the environment” as materiality, and have set cumulativedisbursement targets for sustainable finance and environment finance, and GHG emissions reduction in our own operations as “long-term sustainability KPIs” (targets to be achieved by FY2030). In September 2024, we set a net zero by 2050 target for GHG emissions in the investment and loan portfolio and interim targets for the electric power, oil and gas, and coal sectors for FY2030 in order to actively promote the decarbonization of local customers.

For GHG emissions, calculations are made for Scope 1 and 2 and categories 1 to 15 of Scope 3, and the calculation results have been subjected to third party verification by the Japan Quality Assurance Organization. We will continue to improve and refine our calculation methods.

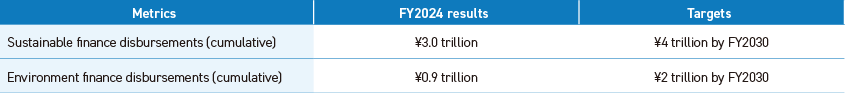

Sustainable finance and environment finance*

Cumulative disbursements of sustainable finance in FY2024 totaled ¥3 trillion, of which ¥0.9 trillion was disbursed in environment finance.

In addition to an increase in demand for funds due to an increase in capital investment aimed at decarbonization, there is a need for new financial products and services. We will continue to enhance our lineup of solutions that will help solve our customers’ issues and provide optimal solutions tailored to our customers’ needs.

- *Total of the Bank of Yokohama, the Higashi-Nippon Bank and THE KANAGAWA BANK (included from FY2023 results

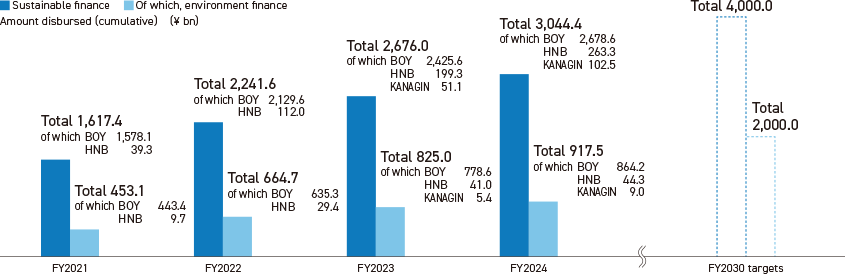

GHG emissions from our own business activities*1

In FY2024, the Group's GHG emissions (Scope 1 and 2) amounted to 3,504t-CO, down 88.1% from the FY2013 level.The Group is working to achieve its targets by introducing energy-saving equipment, switching to high-quality renewable energy sources for its own contracted electricity, and installing solar power panels on its own properties.

- *1Total for the domestic bases of the Company and its consolidated subsidiaries

- *280% reduction compared to FY2013 by FY2024

GHG emissions in the investment and loan portfolio (Sectors with GHG emission reduction targets set)

In FY2023, we set GHG emissions reduction targets in the electric power, oil and gas, and coal-related sectors. In the electric power sector, the emission intensity declined due to an increase in the proportion of loans to renewable energies in the balance of loans to the electric power sector. In the oil and gas sector, emissions remained at a low level despite an increase in emissions due to factors such as an increase in the proportion of financing from the Group to financing by companies subject to calculation.

We have selected coal-fired power generation, coal mining, and oil and gas extraction as specific sectors for sector policy and stipulate that transactions are carefully deliberated. For customers in sectors for which we have set GHG emissions reduction targets, we support the visualization and reduction of their GHG emissions through detailed engagements on an individual company basis.

We will continue to support customers’ efforts to decarbonize their operations by providing optimal solutions based on careful engagement with customers.

Strategy Nature-related

The lives of people and the activities of companies depend on and impact the natural capital of water, air, land, and plants and animals.Because the entire upstream and downstream value chain of business transactions is dependent on and impacts natural capital, companies need to consider both their own operations and the entire value chain when dealing with natural capital.

Financial institutions are linked not only to their own business activities (mainly sales activities at each location), but also to the activities of customers and their supply chains through investment and financing activities. In addition to identifying the relationship between the Group's operations and natural capital, we are also working to identify the “dependency” and “impact” on natural capital of our clients through our investment and financing activities and to appropriately manage risks. At the same time, we are working to seize business opportunities by providing financial products and services related to natural capital.

①Risks (nature-related)

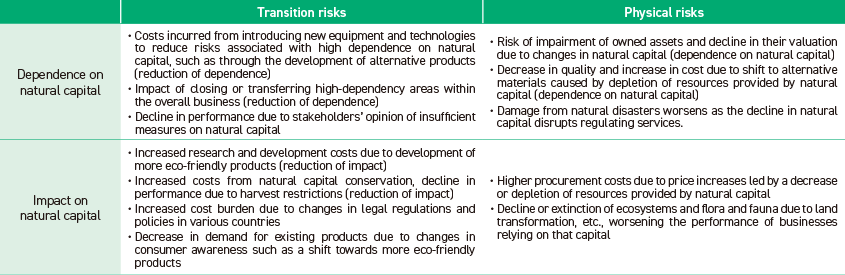

Understanding nature-related risks

In order to understand the relationship between our business and natural capital, our group first organized the nature-related risks of our customers from the perspectives of dependency and impact. The risks we have identified are preliminary, based on our current analysis. We aim to deepen our understanding of the links between our customers and natural capital and how they depend on and impact each other.This will help us more accurately identify potential risk events and enhance our risk awareness.

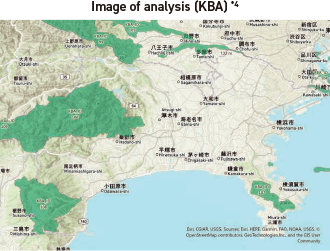

Analysis of dependency and impact at the Group’s locations

In order to identify the negative impact of its operations on the natural environment, the Group analyzed the points of contact with areas of high biodiversity importance, such as protected areas*1, Key Biodiversity Areas (KBA)*2, and the Biodiversity Intactness Index*3, based on information obtained from the domestic bases of the Bank of Yokohama, the Higashi-Nippon Bank, and THE KANAGAWA BANK. As a result, it was confirmed that there are bases that have points of contact with highly important areas of biodiversity, such as the Tanzawa-Oyama and Hakone areas. However, given that these are general offices and are types of businesses that use land that has already been developed, the negative impact on nature is deemed to be limited. We will continue our efforts to reduce the environmental impact of our business activities in order to be environmentally conscious.

- *1A natural park, nature conservation area, or wildlife sanctuary designated by the Minister of the Environment or prefectural governor based on Land Use Master Plans.

- *2Areas of key importance for the conservation of biodiversity, including areas which are not included in the existing protected areas. The results of the KBA survey conducted by Conservation International Japan were used for the analysis.

- *3An indicator of the extent to which an ecosystem has been altered by human activity in a given area.

- *4his map is based on the “Topographic Map (Japanese)” provided by Esri Japan.

© Esri, HERE, Garmin, FAO, NOAA, USGS, OpenStreetMap contributors,GeoTechnologies, Inc., and the GIS User Community

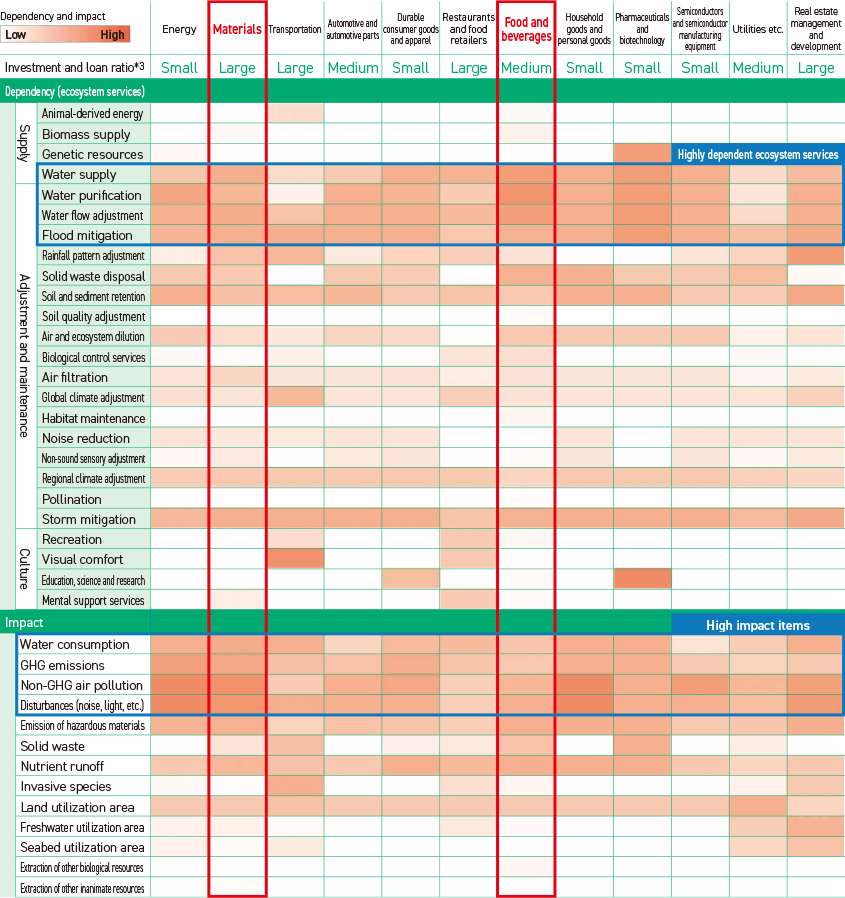

Analysis of dependency and impact in the investment and loan portfolio

In order to understand the relationship with natural capital through its investment and financing activities, the Group used “ENCORE”*1 to analyze the dependence and impact on natural capital in each sector*2. The analysis revealed a high degree of dependence on ecosystem services related to water across sectors, as well as a high degree of impact on natural capital from water use and air pollution. In addition, we narrowed down the sectors that require priority measures (priority sectors), such as the “Materials” and “Food and beverages” sectors, which have a particularly high degree of dependence and impact and are highly weighted in the Group’s portfolio.

In the future, we will identify risks and opportunities for the Group by conducting in-depth analysis of priority sectors (value chain analysis, location analysis, etc.) and assessments of nature-related risks and opportunities, taking into account the relationship with the target sector and the importance in the region.

- *1A tool to understand the degree of dependence and impact on nature of specific economic activities

- *2Based on the analysis of the entire portfolio and with reference to the TNFD’s guidance for financial institutions, etc., the above table shows the results of the analysis of sectors with particularly high dependency and impact.

- *3Percentage of total investments and loans (as of the end of March 2024) (large: over 3%, medium: 1% - 3%, small: less than 1%)

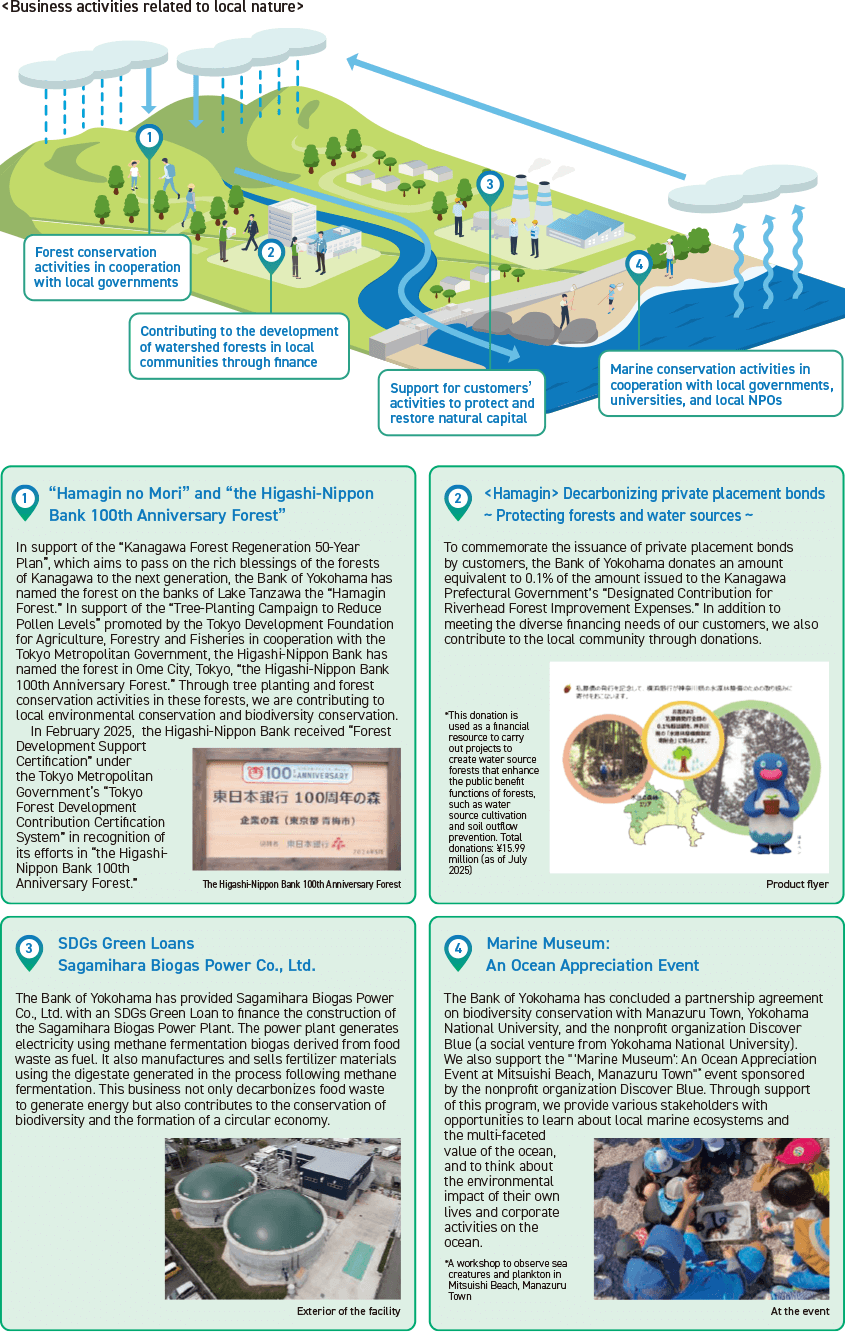

②Opportunities (nature-related)

Supporting customers aiming for nature positive and contributing to local communities

The Group provides financing support and other solutions for projects that contribute to the conservation and restoration of natural capital with the aim of promoting customers’ initiatives to become nature positive. As part of our own efforts, we cooperate with local governments and other organizations to contribute to the preservation and restoration of natural capital in local communities.

As a regional financial institution, the Group will continue to cooperate with various entities, including companies, local governments and educational institutions, and contribute to the transition to a nature-positive local community through activities that spatially capture the relationship with nature.

Metrics and Targets Nature-related

Sustainable finance and environment finance

The Group has set targets for cumulative disbursements of sustainable finance and environment finance as “long-term sustainability KPIs” in order to contribute to solving clients’ environmental and social issues, including responding to climate change and natural capital.See “Metrics and Targets (Climate Change)” for FY2024 results.

Initiatives to reduce the environmental impact of our business activities

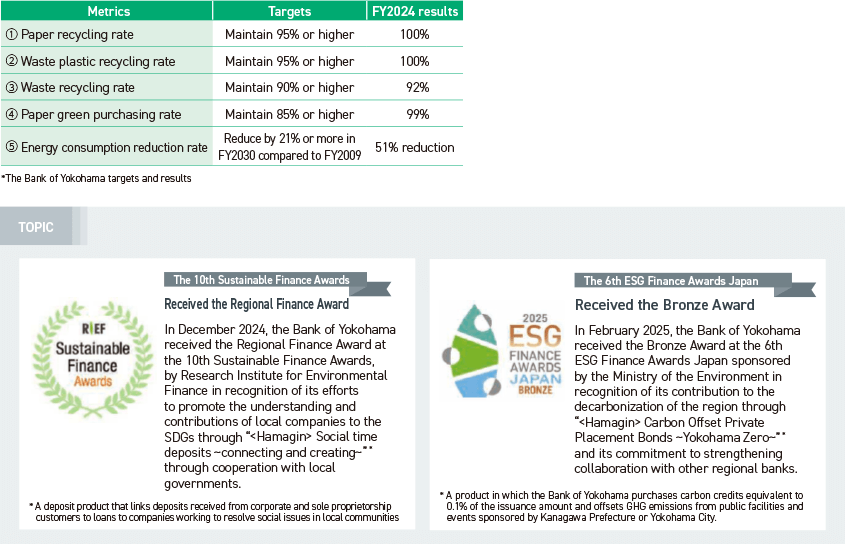

Our Group Environmental Policy sets out to promote resource and energy saving, waste recycling, and effortsto lessen our environmental impact. In our effort to reduce our environmental impact, at the Bank of Yokohama andthe Higashi-Nippon Bank, we set targets for the recycling rates of paper, waste plastic, and waste materials, thegreen purchase rate of paper, and the reduction rate of energy consumption.