A Message from the Director of Finance

Achieved all target indicators in the previous medium-term management plan, record-high revenue in the bottom line (excluding negative goodwill)

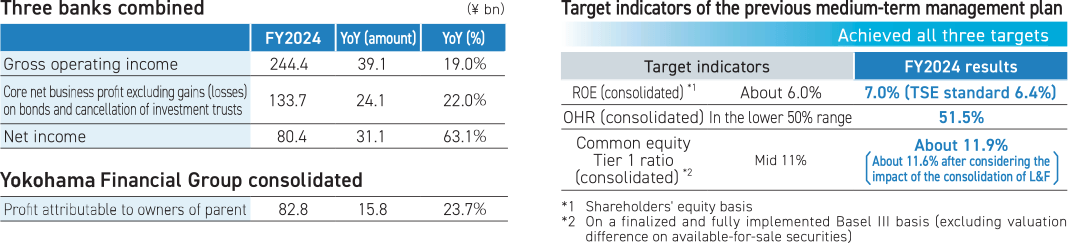

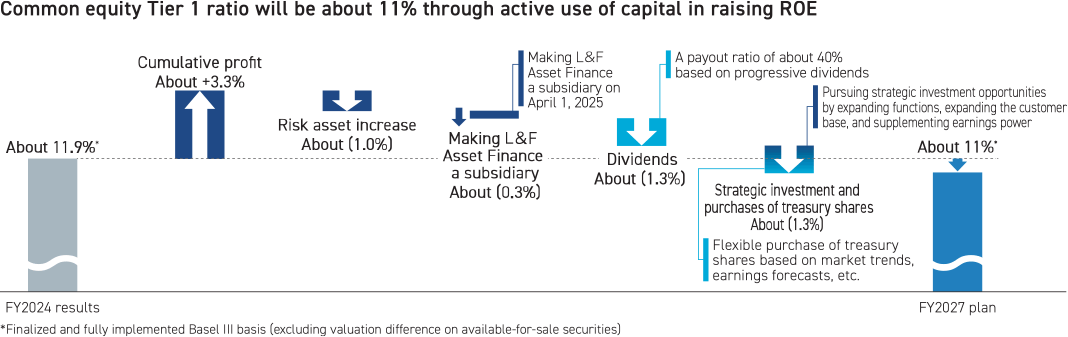

In the last the medium-term management plan from FY2022 to FY2024, we promoted “Deepening and Expansion of Solution Business” as a basic theme for growth and achieved various targets at a high level. ROE (shareholders' equity base) was 7.0%, well above the target of about 6.0%, thanks in part to the BOJ's shift in monetary policy. We were able to keep OHR in the lower 50% range despite wage increases by reducing system costs. Common equity Tier 1 ratio was about 11.9% against the target of mid 11%. However, it was about 11.6% considering the impact of the consolidation of L&F Asset Finance on April 1, 2025, so I believe we achieved the target.

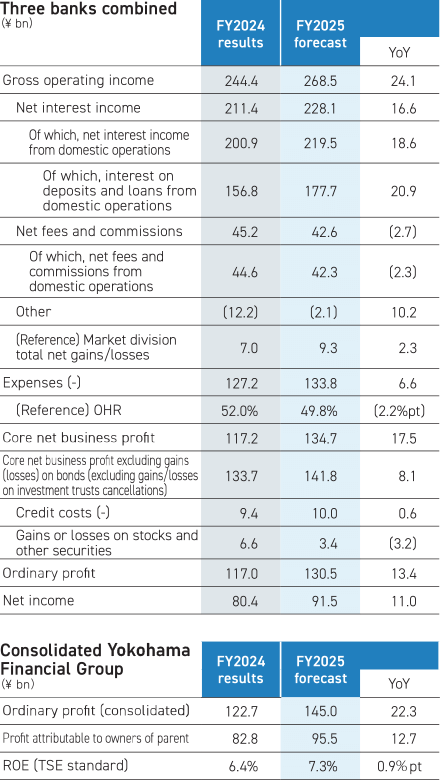

In FY2024, the top line for the three banks combined (gross operating income) increased by 19% from the previous fiscal year to ¥244.4 billion, driven by an increase in interest on deposits and loans from domestic operations due to improvements in yield spread from deposits and loans. In the bottom line (profit attributable to owners of parent), operating income rose 23% to ¥82.8 billion, marking the fourth consecutive year of growth.

Excluding the special factor of “negative goodwill” associated with the business integration in the first year of the Group's establishment, operating income was a record high. TSE standard ROE was 6.4%, exceeding the target, and I believe that this fiscal year brought us one step closer to our vision financially.

On the other hand, the strengthening of the number of sales personnel in order to improve the earnings of the solution business, which was raised in the previous medium-term management plan, ended up falling short of the target, and we recognize it as a challenge. Although we improved the efficiency of administrative personnel operations by introducing tablet terminals and other measures to promote the shift from administrative personnel to sales personnel, the number of customers visiting stores exceeded expectations, and we needed to secure a certain number of personnel. We are also in the process of changing our employeesʼ mindset. Under the new medium-term management plan from FY2025 to FY2027, we will continue our efforts to increase the number of sales personnel.

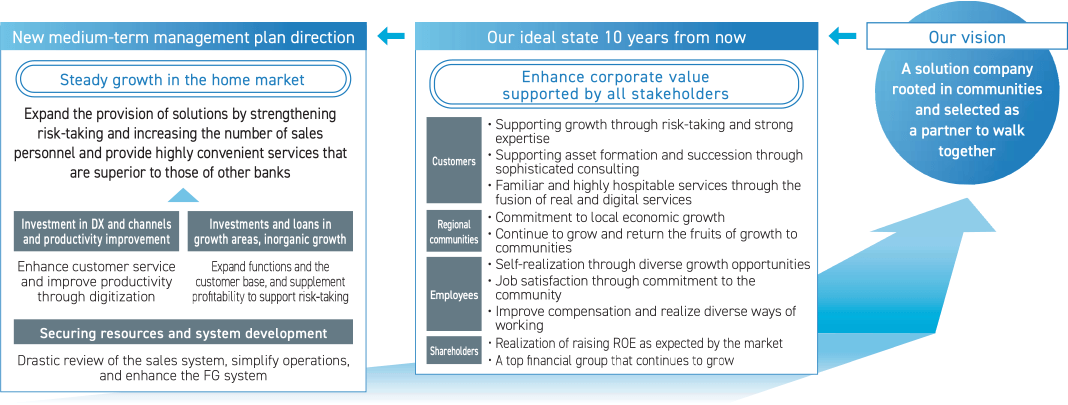

Returning to Relationship Banking for Our Ideal State 10 Years from Now

The new medium-term management plan was established by backcasting from “Our Ideal State 10 Years from Now” and from identifying issues. To achieve steady growth in the home market, we will strengthen risk-taking and the number of sales personnel to expand the number of solutions we offer. We aim to be a “community-based urban financial group” that can provide sophisticated financial services, such as investment-banking and private-banking functions, to individual customers, including small and medium sized businesses and semi-wealthy individuals, where megabanks and major securities companies have not been able to sufficiently cover the limitations of their branch networks and staffing systems. In order to realize this, we need to improve the skills of every employee. We are positioning the next three years as a period for growth. A strong relationship and excellent communication skills are required to fully understand the concerns and issues of customers. In the new medium-term management plan, we have taken the concept of “relationship banking” to heart, and we will steadily advance the plan while returning to our roots.

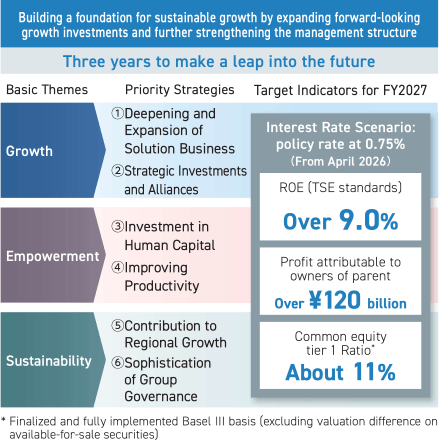

Aiming to achieve ROE (TSE standard) of over 9.0% under the new mediumterm management plan

We have set “profit attributable to owners of parent” as a target indicator of the new medium-term management plan instead of OHR, which had been the target until now. The top line is increasing, and it is possible to reduce the OHR even under inflation. However, the key to raising ROE is net income, and we believe that being firmly committed to these figures is essential to winning the approval of our stakeholders.

The assumption for policy rate is 0.5% in FY2025 and 0.75% from April 2026. The target indicators for FY2027, the final year of the new medium-term management plan, are ROE (TSE standard) of over 9.0%, profit attributable to owners of parent of over ¥120 billion, and common equity Tier 1 ratio of about 11%.

The planʼs figures are not an excessive stretch. We formulated the plan on the premise that we will focus on areas where we can grow while being committed to quality. We intentionally set the FY2027 target indicator for ROE as “over” 9.0%. Even considering the highly uncertain environment, we are strongly committed to achieving a minimum of 9.0% and of reaching close to 10%.

Strengthening earning power by expanding the loan portfolio while maintaining an appropriate risk-return

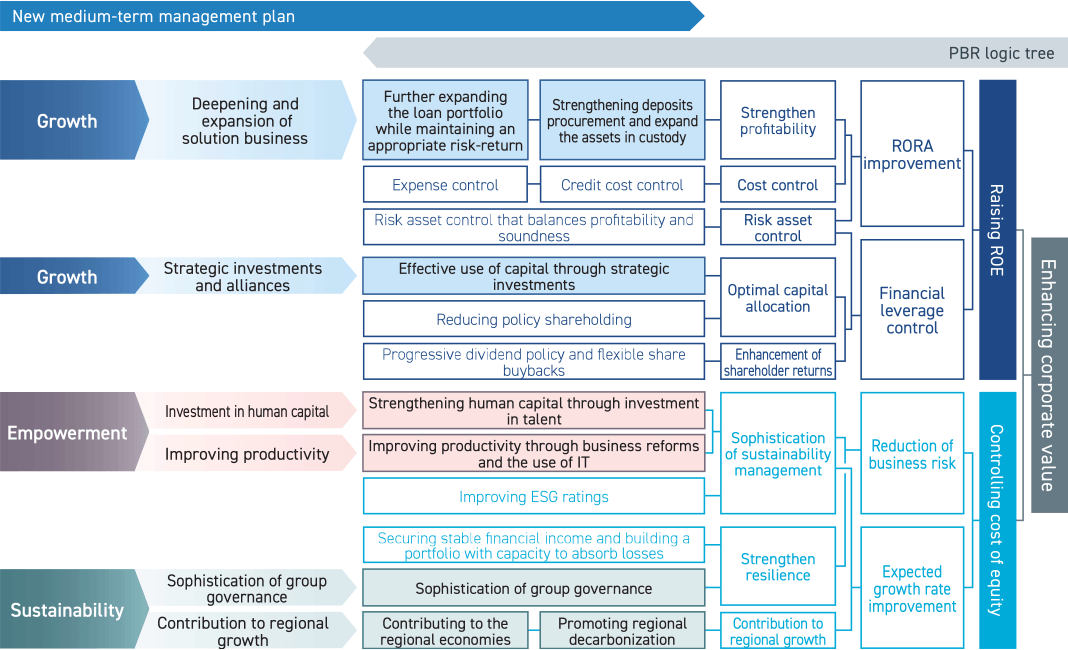

The Group has formulated a logic tree for enhancing corporate value and we share it with employees so that every one of them is aware of it when implementing measures. This framework is also used in dialogue with shareholders, and constructive exchanges of opinions are taking place. Key performance indicators (KPIs) have been established for each measure, and we believe that clearly indicating the status of progress has led to higher expectations from shareholders.

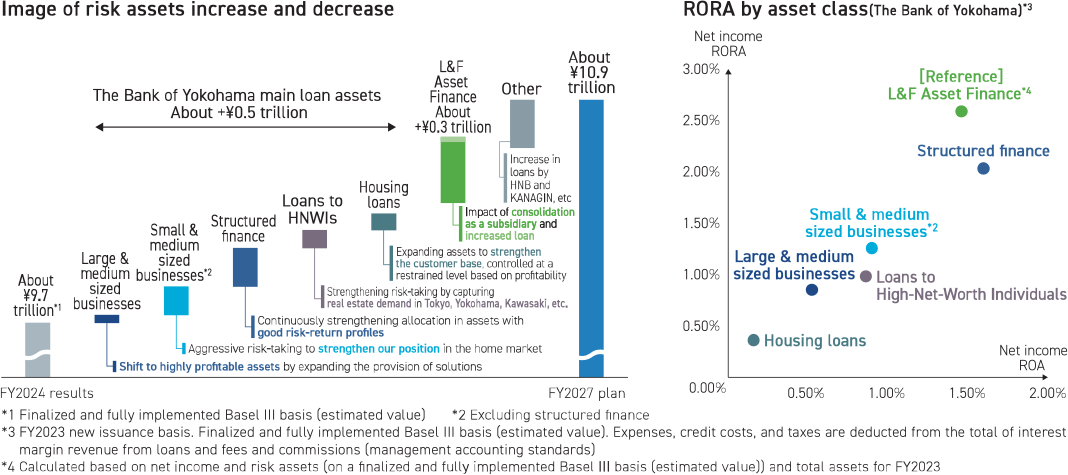

The key to enhancing ROE, which is crucial to increasing corporate value, is to expand the loan portfolio while maintaining an appropriate risk-return. To this end, we will expand our business mainly in fields with a high RORA, such as loans to small & medium-sized businesses, loans to HNWIs and structured finance. At the same time, we will selectively expand loans to large & medium-sized businesses and housing loans, where RORA is low. For loans to large & medium-sized businesses, we will strengthen the provision of solutions and promote a shift to highly profitable assets. Also, housing loans are positioned as an important product to strengthen our customer base, and we will control risk assets to a certain level with an emphasis on profitability while expanding our range.

Enhance highly profitable assets by expanding the provision of strategic solutions

In the new medium-term management plan, we are focusing on the “deepening and expansion of solution business,” a priority strategy under the basic theme of “Growth,” with the aim of expanding high-quality assets. To realize this goal, it is important to provide high-value-added solutions in response to the strong demand for funds in the Tokyo metropolitan area, which is our base of operations.

Market reforms are progressing, partly due to Tokyo Stock Exchange's efforts to “realize management that is conscious of the cost of capital and stock prices.” As the attention of investors, including activists, is focused on the Japanese market, corporate actions, such as moves in delisting, cancellation of parent and subsidiary listings, and M&As, are increasing. The Group does a lot of business with listed companies and is particularly strong with mid- and small-cap customers. As such needs expand, we expect to see an increase in financing opportunities, and we will continue to provide solutions that are chosen by customers.

For our individual customers, we will continue to strengthen our loans to HNWIs, particularly apartment loans. Although material prices have been rising, construction demand has remained strong, particularly in the Tokyo metropolitan area, where rents have been rising. We intend to make the most of the Group's capabilities by accurately identifying such demand for funds.

Strengthening our sticky deposits base by providing services that fit a regional financial institution

Deposits procurement is becoming increasingly important in a world with interest rates. Convenience, security and familiarity are important points for individual customers when opening an account. We believe that as a regional financial institution, we will be able to take advantage of our branch network, which is superior to those of our competitors, and we are reviewing the consolidation and elimination of bank branches carried out so far and discussing new branch strategies. In addition, as the proportion of non-face-to-face contact with customers increases, we are strengthening the functions of our in-house developed smartphone app “Hamagin 365,” and the number of users has exceeded 1.41 million, leading to an increase in transactions.

Although interest rate campaigns have been conducted mainly by online banks, I believe that the trend in deposit transfers based on interest rates have already settled down. We will acquire sticky deposits by providing services that only a regional financial institution can offer. Specific examples include the payment business DX service in partnership with local schools to attract new accounts from young people and discount programs in partnership with local retail chains. We will continue to work to maintain and expand the deposit balance by emphasizing the convenience of our stores.

At the end of the previous fiscal year, for the first time in a long time, we conducted a time deposits interest rate campaign in The Bank of Yokohama targeting transfers from other banks. This time, the purpose was to verify from a marketing point of view how many deposits we could receive by running a campaign. We received more deposits than we had initially expected, and many customers stated that they wanted to use The Bank of Yokohama, which has branches close by, rather than online banks. In the future, we will focus on communication with new customers, examine the effects of these efforts, and apply the experience gained to the following measures.

We have been able to steadily increase the balance of corporate deposits as a result of our efforts to secure ordinary transactions and promote the transfer of deposits based on our strong relationships with customers. We believe that increased awareness of the significance of deposits at sales sites has also contributed to the results.

Strengthening human capital through investment in talent and improving productivity through business reforms

As we aim to become an urban financial group with strong ties to the local community, it is essential to develop and secure human resources capable of providing advanced financial services. We are upgrading the solution sales structure of the Group as a whole by visualize skills and promoting human resource development by linking OJT and group training (Off-JT), as well as by rotating experienced human resources working in head office and the highly competitive Tokyo Metropolitan area as planned. In order to retain and secure human resources, we revised our personnel system and evaluation system last fiscal year and are working to assign employees according to their wishes and to realize fair and equitable evaluation and treatment.

We are also promoting improving productivity through operational reforms to create an atmosphere in which employees can concentrate on high-value-added work. We are working to change the mindset of management by, for example, stopping or not increasing unnecessary operations that have been identified through the visualization of business processes. As an example of this, we have discontinued the preparation of expected questions and answers for the General Meeting of Shareholders. I believe that we revitalized dialogue in the General Meeting of Shareholders by not spending time preparing these in advance and by providing the voices of the directors in charge. From this fiscal year, we have newly established the “Productivity Improvement Office” to promote the cross-organizational improvement of productivity and further promote better operational efficiency.

Accelerating the reduction of policy shareholdings

We reviewed the plan to reduce policy shareholdings from the viewpoint of capital efficiency, etc., and formulated a new plan to reduce the balance of shareholdings on a market value basis to less than 10% of consolidated net assets by the end of March 2030.

As shareholders are also reducing their policy shareholdings,we believe we can accelerate the pace at which we reduce policy shareholdings. However, in consideration of the liquidity of shares, we have set a period for the plan. I want to note that no transfer from policy shareholdings to net investment stocks will be made.

Review required capital levels and increase financial leverage for raising ROE

In order to raise ROE, it is important to increase financial leverage in addition to improving RORA through the solutions business.

As part of our efforts to increase financial leverage, we have set a target to lower common equity Tier 1 ratio from the mid 11% level to about 11% by FY2027. In the past, we anticipated tail risks such as the Lehman shock, so we had a bigger capital buffer. However, in light of the capital resilience created by our increased earnings power, we have determined that we can withstand the risk with a smaller buffer. By increasing the number of healthy risk assets, we will increase our financial leverage and raise ROE. The common equity Tier 1 ratio will be lowered, but by expanding the use of Tier 2 capital such as subordinated bonds, we will maintain soundness while raising capital efficiency.

Utilizing capital while balancing strategic investment and shareholder returns

By lowering the required capital level, we will be able to make more active use of capital for raising ROE. As a strategic investment, making L&F Asset Finance a subsidiary in April 2025 is expected to improve the Group's ROE by about 0.4%. By utilizing the capital entrusted to us by our shareholders, we will actively source projects that contribute to improving capital efficiency and take on the challenge of creating strategic investments that contribute to the sustainable growth of our company.

On the other hand, if no appropriate investment opportunities are found, or if the target capital level is exceeded, we aim to achieve a common equity Tier 1 ratio of about 11% by enhancing shareholder returns such as share buybacks. We will promote strategic investment that contributes to raising ROE while keeping in mind the balance between capital utilization and shareholder returns.

There will be no change to our dividend policy, which is based on progressive dividends and a payout ratio of about 40% as a guideline. However, dividends per share are expected to steadily increase in line with the growth of profit attributable to owners of parent.

Planning for an increase in net income of about ¥13 billion in FY2025 compared to the previous year

For FY2025, the first year of the new medium-term management plan, we are assuming the policy rate will stay at 0.5%. While the policy rate is maintained, the rise in interest rates to date will be reflected in the loan interest, and the income from loan interest is expected to increase. On the other hand, deposit interest, which is a procurement cost, is also expected to increase, but the top line will increase due to improvements in yield spread from deposits and loans.

In corporate, which had significantly exceeded the plan in the previous fiscal year due to strong performance in structured finance, net fees and commissions from domestic operations are projected to remain flat with the intention of controlling the degree of risk-taking. In the individual division, as we are now in a world with interest rates, we have factored in shifting personnel from investment-type product sales to more profitable loans to HNWIs, resulting in a planned decline in sales. The plan is based on an awareness of the lower limit, and we believe that there is a possibility of exceeding expectations.

The market division is planning to make a capital loss of ¥7 billion by cutting losses on investment trusts with low potential for recovery of valuation gains and losses in order to improve its portfolio. On the other hand, since the amount of loss cutting will decrease compared to the previous fiscal year, market division income is expected to increase.

Expenses are expected to reflect wage increases and price increases, as well as an increase in infrastructure costs such as store renovations and system upgrades.

As a result, we project a 15% year-on-year increase in profit attributable to owners of parent to ¥95.5 billion and a 0.9% increase in ROE to 7.3%.

If there is a downside risk to the plan, I think it is credit costs. The actual result for FY2024 was ¥9.4 billion. In FY2025, however, we plan to maintain this figure at ¥10 billion, or a little over ¥30 billion over the three years of the new medium-term management plan. In FY2024, there was almost no allowance for specific loan losses due to bankruptcy or other reasons. However, we were able to strengthen our preparations for the future by tightening our allowance standards for general loan losses. Although no highly probable risks have emerged at this point, we conducted a stress test considering the impact of tariffs and estimate that the cumulative credit costs of the automobile industry over the three-year period of the new medium-term management plan will be a maximum of about ¥8 billion. Even if there is an impact, we believe that it will be within the plan by being distributed over the period.

Build a foundation to support sustainable growth by expanding forward-looking growth investments and strengthening the management structure

Changes in interest rates in Japan have increased the earning power of the banking industry. At the same time, there is a need to respond to domestic issues such as the declining birthrate, aging of society and decreasing population.

Although we operate mainly in the competitive markets of Kanagawa and Tokyo prefectures, in order to achieve sustainable growth, we must not only enhance our provision of solutions capabilities but also take on the challenge of non-continuous growth through strategic investments that utilize capital. By leveraging the experience accumulated through the business integration so far, we will expand investment for future growth.

Also, in anticipation of future expansion of the Group, in June we transitioned to a Company with an Audit and Supervisory Committee. Through the sophistication of group governance, we will build a foundation that supports sustainable growth.

In October, we will enter a new phase as the “Yokohama Financial Group” towards the milestone of 10 years since the 2016 business integration. We will continue to work onenhancing corporate value, supported by all stakeholders, with the aim of making further progress so that we can be regarded as a “leading regional bank.”