Corporate Governance

Basic Concepts

We have a Corporate Governance Basic Policy that establishes policies and frameworks for achieving effective corporate governance with the aim of promoting sustainable growth of the Group and improving corporate value over the medium to long term. We constantly review our philosophy of corporate governance and work to improve it.

Furthermore, based on our Management Principles, we manage in a way that contributes to value creation for various stakeholders such as shareholders, customers, employees, and local communities, we are ensuring the fairness, transparency, and speed of decision-making, and we are building a corporate governance system appropriate for a financial group.

Basic Policy on Corporate Governance

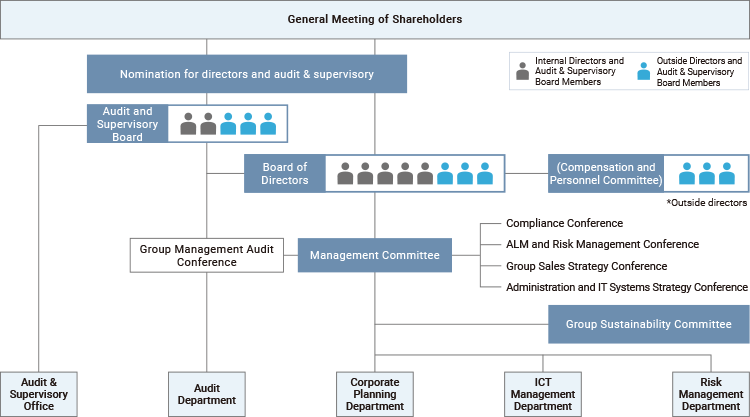

Corporate Governance System

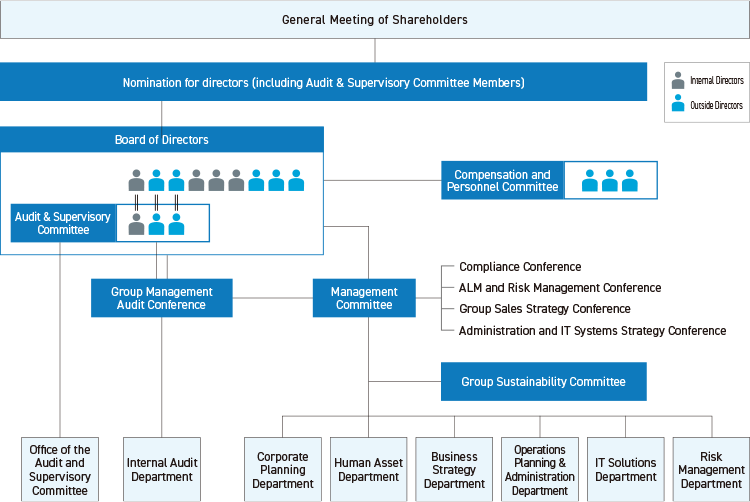

As a company with an Audit and Supervisory Board, the Board of Directors, auditors, and the Audit & Supervisory Board had been supervising management in the Group. Following a resolution to amend the Articles of Incorporation at the ordinary general meeting of shareholders held in June 2025, the Company transitioned to company with an Audit and Supervisory Committee. Along with this, Audit & Supervisory Committee Members, including independent outside directors, will exercise their voting rights in board meetings, and the Audit & Supervisory Committee will check important documents to audit the legality and appropriateness of the status of directors’ business execution and enhance the effectiveness of its supervisory function of management. In addition, the Compensation and Personnel Committee continues to be composed exclusively of independent outside directors to ensure objectivity and transparency in compensation and personnel matters for directors and executive officers.

Composition of the Board of Directors and the Audit & Supervisory Committee

In order to ensure that the Board of Directors functions most effectively and efficiently, and from the perspective of revitalizing the Board of Directors, the Articles of Incorporation stipulate that the number of directors (excluding directors who are Audit & Supervisory Committee Members) be no more than seven and the number of directors who are Audit & Supervisory Committee Members be three.

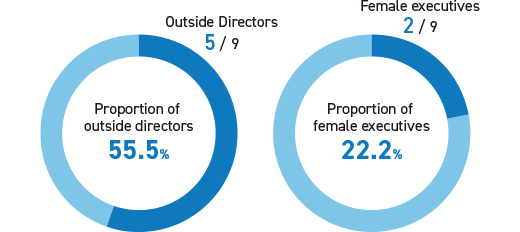

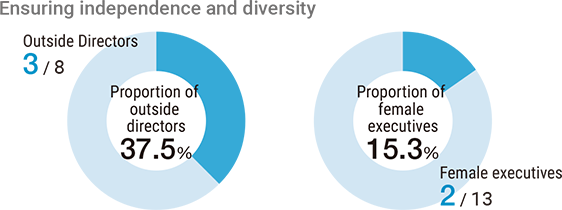

In order to ensure the independence of the Board of Directors and to demonstrate that it functions fairly and transparently, the Company appoints a number of outside directors who maintain views that are independent from the Group, making up at least one-third of the members. By combining internal directors who are familiar with the Group’s business with outside directors with extensive experience and knowledge outside the Company and giving the Board of Directors diverse members with different backgrounds of specialist knowledge and experience, the group ensures a good balance of knowledge,experience and skills on the Board of Directors. Of the nine directors (seven men and two women), five are independent outside directors.

The Audit & Supervisory Committee consists of three members (two men and one woman), two of whom are independent outside directors(Audit & Supervisory Committee Members).

- ※The Company recognizes ensuring diversity in the Board of Directors and promoting female activities as important management challenges.

Regarding the proportion of female executives, in support of the Japan Business Federation's challenge to achieve 30% female executives by 2030, the Company is promoting DEI initiatives to raise the ratio of female executives to at least 30% by 2030.Ensuring independence and diversity

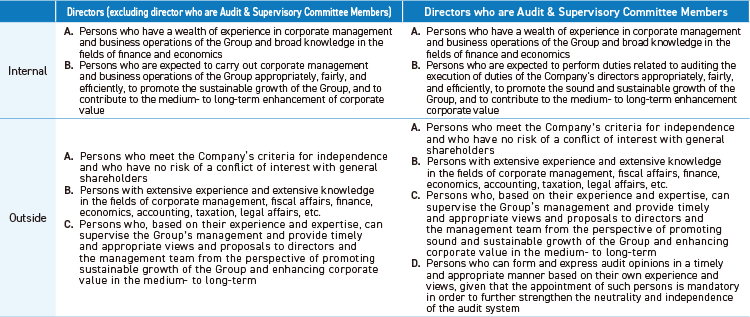

Considerations for the Appointment and Dismissal of Directors

(1) Policies and procedures for appointing candidates for directors

Candidates for directors (excluding directors who are Audit & Supervisory Committee Members) are appointed by the Board of Directors after any deliberation by the Compensation and Personnel Committee. In addition, candidates for directors who are Audit & Supervisory Committee Members are appointed by the Board of Directors after any deliberation by the Compensation and Personnel Committee and with the consent of the Audit & Supervisory Committee. Persons satisfying the following items are appointed from among candidates. In appointing, the Company will take into account the Company's policy on the composition of the Board of Directors and the length of his/her service as an Officer of the Group, etc.

(2) Policies and procedures for the dismissal of directors

If a director is deemed to fall under the items listed on the right, the Board of Directors will submit a proposal to the General Meeting of Shareholders for the dismissal of the director. In addition, the dismissal of directors will be decided by the Board of Directors after deliberation by the optional Compensation and Personnel Committee.

The President and Representative Director of the Company and the Presidents of the Group banks are evaluated based on the evaluation items of (1) business performance, (2) leadership and execution ability, (3) human resource development (successor development), and (4) strategic response, as a material for judging whether or not to continue in the next fi scal year and for their awareness, and feedback is provided by Compensation and Personnel Committee members.

Board of Directors

The Board of Directors makes decisions on important matters such as matters related to the management plan and governance and basic policies on risk and compliance in order to enhance discussions on the management strategies of the Group. Directors who are Audit & Supervisory Committee Members are directly involved in the discussions and decision-making processes of the Board of Directors and thus assume a highly effective supervisory function over management. In addition, in order to strengthen cooperation within the Group and enhance governance, the Company and the Bank of Yokohama have integrated the operation of the Board of Directors, and a system has been established where the Company's directors can participate in the Higashi-Nippon Bank’s board meetings, etc. as observers.

Points discussed at Board of Directors meetings (FY2024: 15 meetings held)

(1) Management plan

- Group medium-term management plan

- Overall group budget

- Group capital plan

(2) Items related to sustainability

- Status of response to TCFD and TNFD

- Ratings by ESG rating agencies

- Engagement strategies for a net zero investment and loan portfolio

- Revision of the environmentally and socially conscious investment and loan policy (sector policy)

(3) Items related to corporate governance

- Risk appetite statement

- Evaluation of effectiveness of the Board of Directors

- Evaluation of internal control system

- Transition to a company with an Audit and Supervisory Committee

(4) Risk and compliance matters

- Risk management policy

- Compliance programs

- Enhancement of basic internal audit plan and internal audit system

Establishment of annual themes

With the aim of promoting the Company’s sustainable growth and enhancing its corporate value over the medium to long term, we establish “annual themes” for the Board Meetings to enrich strategic discussions. In FY2024, extensive discussions were held toward the establishment of the New Medium-term Management Plan.

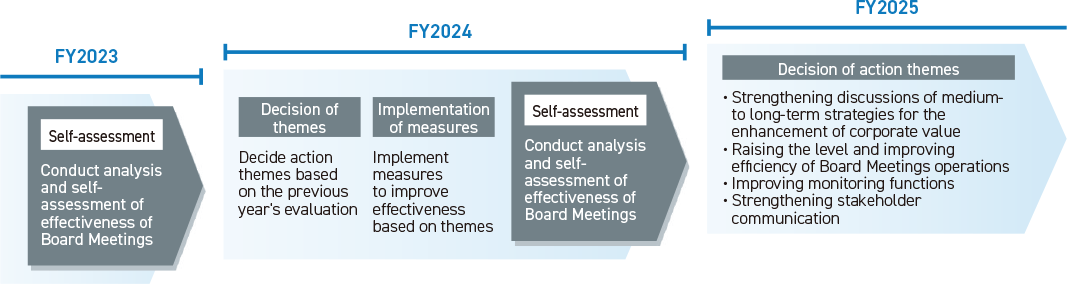

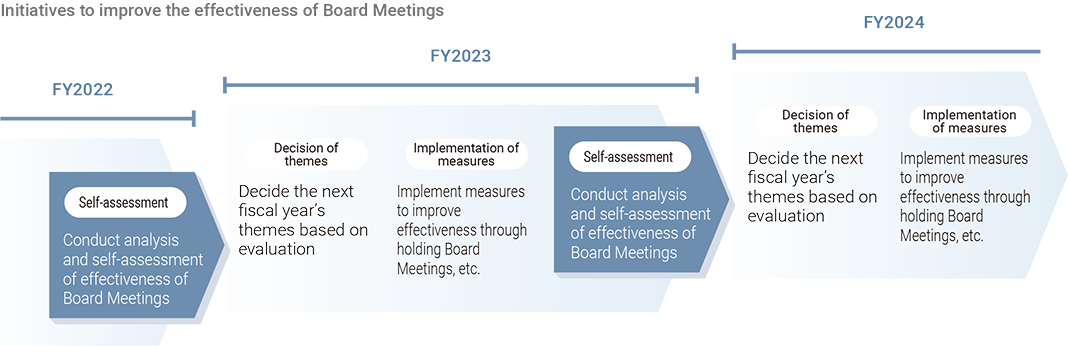

Evaluation of Board of Directors effectiveness

The Company analyzes and evaluates the effectiveness of the Board of Directors as to whether it is fulfi lling the mandate of shareholders and appropriately fulfi lling its roles and responsibilities that contribute to the enhancement of corporate value of the Group. Based on the evaluation results, we clarify the issues of the Board of Directors and strive to continuously improve its effectiveness.Evaluation method

Our effectiveness assessment is based on questionnaires and interviews from the perspective of utilizing third party viewpoints, the results of which are tabulated and analyzed, before the selfassessment is conducted. The specifi c assessment method is as follows.

- We had all the directors who attend the Board of Directors meetings complete a questionnaire, which was handled by a third party to ensure objectivity and anonymity.

- Interviews were conducted with each director in order to confi rm and gather specifi c opinions on the results of the questionnaire.

- After compiling and analyzing the results of 1 and 2 above, the Board of Directors deliberates on and shares about whether the Board of Directors as a whole is effective in light of the roles and responsibilities it should fulfi ll, and conducts a self-assessment.

- Based on the results of the evaluation in 3 above, formulate themes for action for the following fi scal year.

Main questionnaire items

- Composition of the Board of Directors

- Support system for directors

- Operation of the Board of Directors

- Engagement with shareholders (investors)

- Discussions at board meetings

Summary of the results of the FY2024 Board of Directors effectiveness assessment

In FY2024, in light of the roles and responsibilities to be fulfi lled by the Board of Directors, we set four themes to be continuously addressed and promoted initiatives such as holding discussions toward the formulation of the New Medium-term Management Plan and enhancing directors' study sessions, participating as observers in mutual meetings aimed at eliminating information gaps between groups,appropriately following up on the management plan and the overall budget, and ensuring opportunities for substantial dialogue with investors, to improve the Board Meeting effectiveness. As a result, the Board of Directors conducted and shared a self-assessment that “the Board Meetings as a whole continued to be generally effective.”

In FY2025, based on the evaluation of effectiveness in FY2024, we will work to further improve the effectiveness of the Board Meetings in order to promote sustainable corporate growth and enhance corporate value over the medium to long term.

For more information, please see our Corporate Gover nance Report.

Initiatives to improve the effectiveness of Board Meetings

Audit & Supervisory Board and Audit & Supervisory Committee

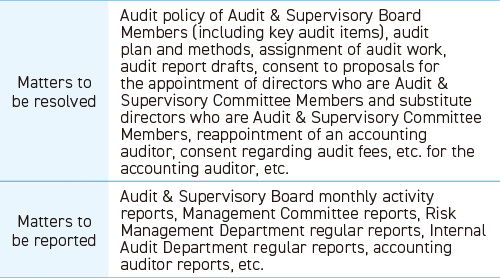

(1) Audit & Supervisory Board

Audit & Supervisory Board Members have audited the legality and appropriateness of directors’ business execution through the following investigations based on the audit policy and audit plan set by the Audit & Supervisory Board.

- Attending important meetings, such as Board of Directors meetings,examining the state of operations and assets, reviewing documents related to important decisions, etc.

- Regular or ad hoc meetings with the Internal Audit Department, the Internal Control Department, and Group companies, etc.

- Exchanging information with accounting auditors, discussing key audit matters (KAMs), receiving reports on the status of audits, etc.

In FY2024, we mainly focused audits on the “status of initiatives aimed at sustainable growth and medium- to long-term enhancement of corporate value,” and the “status of establishment and operation of the Group’s internal control systems.” The findings were compiled as the Audit & Supervisory Board Observations and reported to the Board of Directors and the Management Committee. The Audit & Supervisory Board has conducted self-assessments on the effectiveness of operations and activities of the Audit & Supervisory Board. In concrete terms, each Audit & Supervisory Board Member conducted a self-assessment based on a questionnaire that was discussed by the Audit & Supervisory Board. Based on the aggregate results,opinions were exchanged by the Audit & Supervisory Board, and efforts were made to improve the management and activities of the Audit & Supervisory Board.

Main topics of Audit & Supervisory Board meetings (FY2024)

(2) Audit & Supervisory Committee

The Company transitioned to a company with an Audit & Supervisory Committee in June 2025.

The Audit & Supervisory Committee works closely with the Internal Audit Department, the Internal Control Department, and accounting auditors to conduct systematic, effective, and effi cient audits utilizing the Company's internal control system. In addition, the Audit & Supervisory Committee decides opinions on the appointment, dismissal,etc., and compensation, etc., of directors (excluding Audit & Supervisory Committee Members) as a supervisory function for business executives.

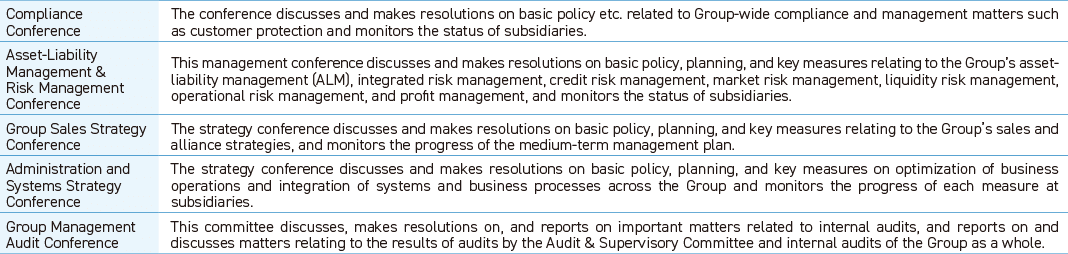

Management Committee

The Management Committee, which consists of representative directors, directors, and others, is established under the Board of Directors.

Based on the basic policy and management plans decided by the Board of Directors, the Management Committee discusses and decides on important business execution matters and strategies for fl exible business execution within the Group, and also holds preliminary discussions on resolutions of the Board of Directors as necessary.

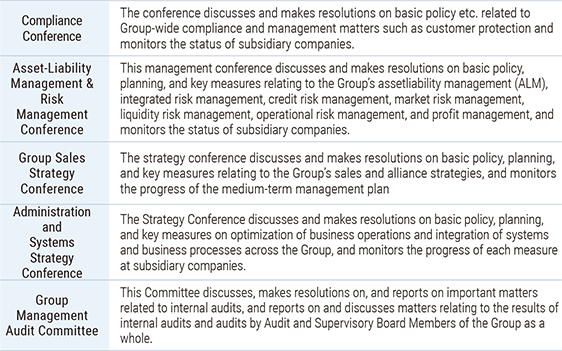

In addition, for important matters related to the Group’s business execution, the meetings listed below are positioned as part of the Management Committee, and these meetings conduct intensive deliberation on items within their respective jurisdictions.

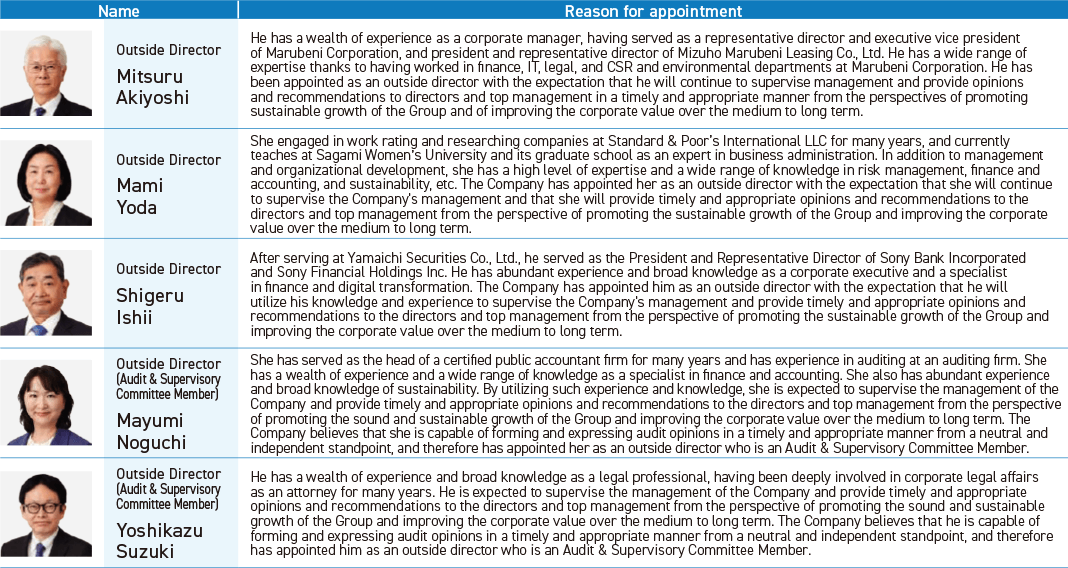

Reasons for Appointment of Outside Officers

Support for Directors

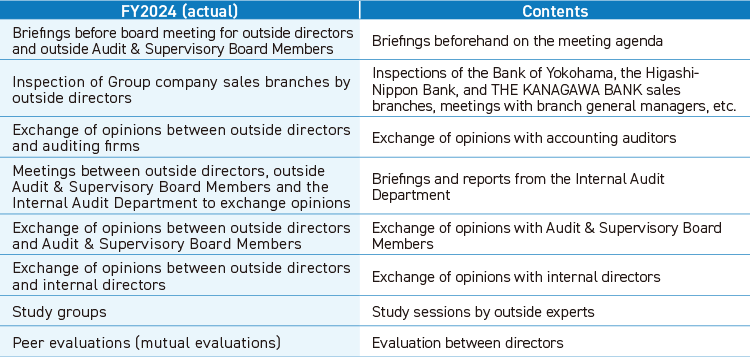

In order to enhance Board of Directors meetings, the Company provides outside directors with advance explanations of the agenda of the Board of Directors meetings, as well as opportunities for on-site visits to sales branches of the Group companies. When outside directors are appointed, they are provided with the opportunity to acquire knowledge and information about the Group’s management philosophy, management policies, business plans, and business structure. Furthermore, we work for coordination between the Representative Director, the Internal Audit Department, and accounting auditors, as well as for interchange between the outside directors and the directors of Group companies.

In order to ensure that directors obtain information about the company in a timely and appropriate manner, a staff member is assigned to the Corporate Planning Department to assist directors in obtaining information. To ensure that audits by the Audit & Supervisory Committee are conducted effectively, we have a dedicated staff member in the Office of the Audit and Supervisory Committee to support audits by the Audit & Supervisory Committee.

To enable directors to fulfi ll their roles and responsibilities, the Company provides opportunities to obtain knowledge and information, receive advice from external experts, and raise awareness through peer evaluations (mutual evaluations) by directors.

Discussions between outside directors and investors/analysts

At our Investor Relations Day in February 2025, outside directors had an opportunity to meet with investors and analysts in order to directly hear and deepen their understanding of voices from the market.

Study sessions by outside experts

In order to enhance Board of Directors deliberations and improve governance,study sessions were held by outside experts, focusing on themes related to digital/IT, sustainability, and open innovation. In addition, we held study sessions on market trends in order to promptly respond to changes in the fi nancial market.

Visits to sales branches of Group banks by outside directors

In order to deepen their understanding of the Group banks’ business operations and sales sites, outside directors inspected the Bank of Yokohama, the Higashi-Nippon Bank, and THE KANAGAWA BANK sales branches. At the sales branches,they observed business operations and held meetings and discussions with regional headquarters managers and branch general managers.

- ・The Bank of Yokohama Sagamihara Ekimae Branch, Yokohama Ekimae Area

- ・The Higashi-Nippon Bank Kamata Branch

- ・THE KANAGAWA BANK Sagamidai Branch

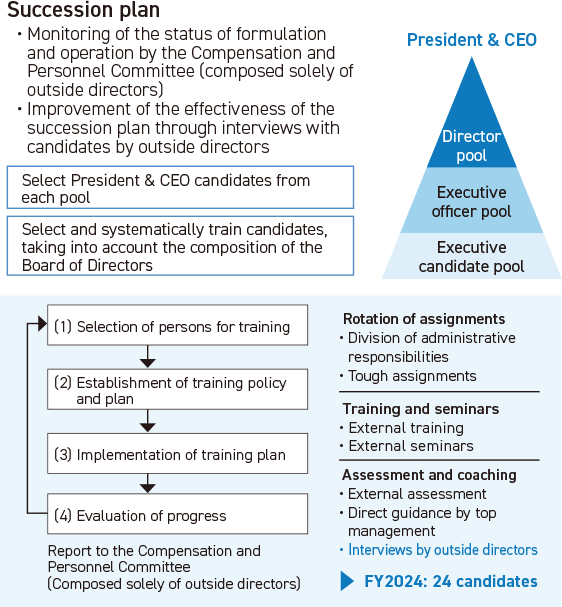

Succession plan

In order to promote sustainable growth and enhance corporate value over the medium to long term, the Group has formulated a succession plan for the top management of the Company and its major subsidiaries, the Bank of Yokohama and the Higashi-Nippon Bank.

The succession plan is divided into three groups: the director pool, the executive Officer pool, and the executive candidate pool, and candidates for President & CEO are selected from each pool every year. In the selection process, members from the Compensation and Personnel Committee exchange opinions with the President and the CEO of subsidiary banks. By implementing training programs tailored to the candidates’ capabilities, qualities, experience, etc., we are systematically cultivating human resources who will take on top management roles in the future. Specifi cally, we aim to broaden the scope of knowledge and skills of candidates through planned rotations of assignments, training and seminars, and to raise awareness among candidates through external assessments and interviews with outside directors and top management.

The status of the formulation and operation of the plan is regularly reported to the Compensation and Personnel Committee, which is composed solely of outside directors. Outside directors not only receive reports but also strive to improve the effectiveness of the succession plan by gaining a multifaceted understanding of the candidates through various meetings, interviews, and discussions, and by providing advice and recommendations to the candidates based on their extensive knowledge and experience.

Succession plan

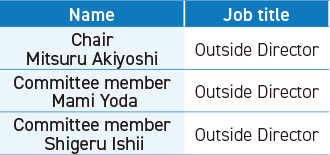

Compensation and Personnel Committee

For the purpose of ensuring objectivity and transparency in compensation and personnel matters of directors and executive Officers, a Compensation and Personnel Committee composed solely of independent outside directors has been established as a voluntary mechanism. The Compensation and Personnel Committee performs the functions of both a nominating committee and a compensation committee. The Chairperson of the Committee shall be elected from among the members of the Committee and shall serve as the Chair. As a general rule, the President provides explanations, and if necessary, the Chairperson may appoint a person other than a committee member to attend the meeting and hear his/her report or opinion. The secretariat is established in the secretarial Office of the Corporate Planning Department, and meetings are held as needed. In FY2024, 12 meetings were held.

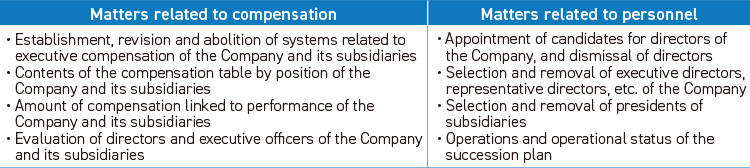

[Authority and roles of the Compensation and Personnel Committee]

The Committee resolves and deliberates on the compensation and personnel matters of Officers of the Company and its subsidiaries.

In the past, with respect to the determination of the amount of individual compensation for directors, the Board of Directors entrusted the President and Representative Director within the limit determined by a resolution of the General Meeting of Shareholders,and the exercise of such authority was subject to deliberation by the Compensation and Personnel Committee. Starting from July 2025, the Compensation and Personnel Committee is entrusted with the determination to enhance the transparency of the compensation determination process.

1. Compensation for Officers of the Company and its subsidiaries

Matters to be resolved

- Contents of the compensation table by position of the Company and its subsidiaries

- Individual compensation amounts of directors (excluding directors who are Audit & Supervisory Committee Members) and executive Officers of the Company

- Amount of compensation linked to performance of the Company and its subsidiaries

- Evaluation of achievement of performance targets for medium to long term incentive compensation of the Company and its subsidiaries

Matters to be deliberated

- Establishment, revision and abolition of systems related to executive compensation of the Company and its subsidiaries

- Performance evaluation of directors and executive Officers of the Company

- Individual compensation amounts of directors who are Audit & Supervisory Committee Members of the Company

Matters to be reported

- Performance evaluation of directors and executive Officers of the subsidiaries

- Individual compensation amounts of directors and executive officers of the subsidiaries

2. Personnel matters regarding Officers of the Company and its subsidiaries

Matters to be deliberated

- Appointment of candidates for directors of the Company, and dismissal of directors, and selection and removal of executive directors, representative directors, and the President and Executive Officer of the Company

- Selection and removal of presidents of subsidiaries

Members of the Compensation and Personnel Committee

Matters to be deliberated and reported in FY2024

Executive Compensation System

The Company has adopted by resolution of the Board of Directors a policy (‘the Policy’) concerning decisions on the details of remuneration etc. for individual directors (excluding directors who are Audit & Supervisory Committee Members). The outline of the document is as follows. This policy was decided after deliberation by the Compensation and Personnel Committee, which is comprised solely of outside directors.

1. Directors (excluding directors who are Audit & Supervisory Committee Members)

(1) Basic policy

- The compensation system for directors is to function as an appropriate incentive to promote the sustainable growth of the Group and increase its corporate value over the medium to long term, while minimizing excessive risk-taking.

- Compensation composition, compensation composition proportions, and compensation levels are determined through periodic comparisons and verifi cation based on data on executive compensation from external research organizations and objective survey data, using as benchmarks a group of companies with performance and business conditions similar to those of the Company.

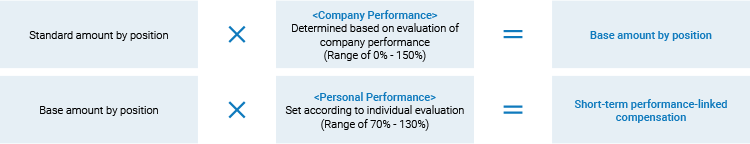

(2) Compensation composition and details

[Directors (excluding non-executive directors and outside directors)]

*1 In the event of a serious violation of a mandate contract between the Company and an Officer concerning the Officer’s duties, or in the event of a sudden deterioration in business performance or a serious incident or scandal that damages corporate value, the Company may require that the Officer forfeit stock delivery points (zeroing out), return granted Company shares, etc. (clawback), or provide compensation.

*2 The Company has established “Stock Acquisition and Ownership Guidelines” and encourages directors, etc. of the company and its subsidiaries to acquire and hold a certain number of shares of the company’s common stock in order to make them aware of management from the perspective of shareholders.Performance-linked indicators and reason for selection

[Non-executive Directors/Outside Directors]

- A. Compensation composition

-

- In view of the role in supervising execution of business, compensation of non-executive directors and outside directors is not linked to performance, and only basic (fi xed) salary is paid.

- B. Compensation details

-

- Basic salary is paid monthly based on role and responsibilities.

2. Directors who are Audit & Supervisory Committee Members

The details of compensation etc. for directors who are Audit & Supervisory Committee Members are determined through discussions with them and the details are as follows.

- A. Compensation composition

-

- To ensure neutrality and independence of directors who are Audit & Supervisory Committee Members, compensation is not linked to performance, and only basic (fi xed) salary is paid.

- B. Compensation details

-

- Basic salary is paid monthly based on role and responsibilities.

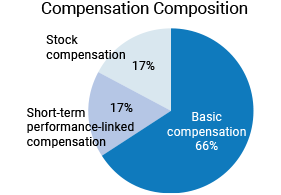

3. Composition of compensation by position

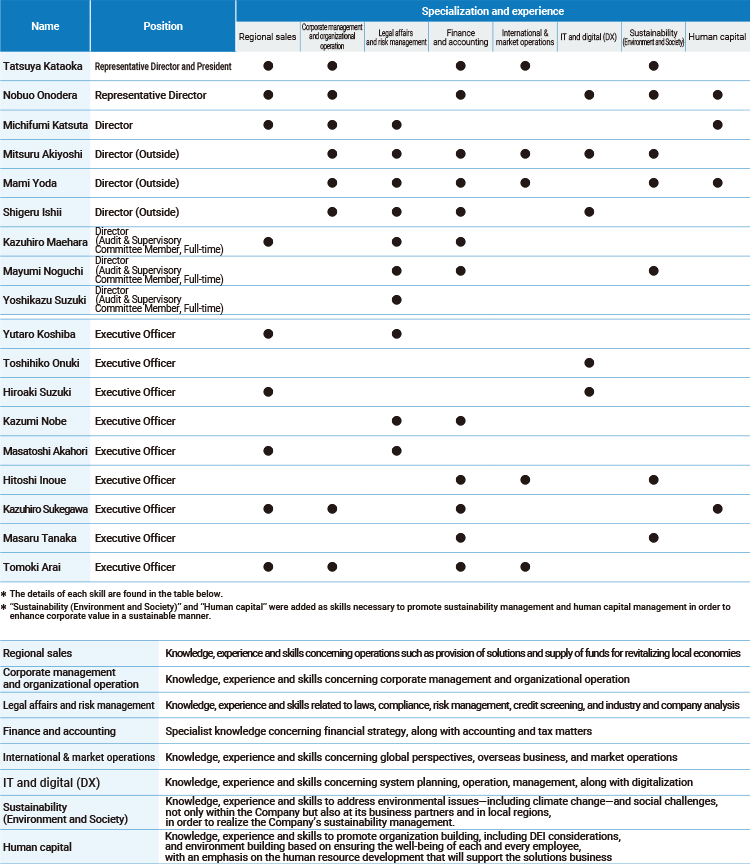

Specialization and experience of directors and executive Officers (skill matrix)

The specialization and experience required by the Company are considered to be “Regional sales,” which is essential for understanding the business models of subsidiaries that are regional financial institutions; “Corporate management and organizational operation,” “Legal affairs and risk management,” and “Finance and accounting,” which are universally required for corporate management; “International & market operations” and “IT and digital (DX),” which are required to provide more advanced expertise necessary to respond to the changing business environment; “Sustainability (Environment and Society),” which is required to solve issues in the environmental and social domains in order to enhance corporate value in a sustainable manner; and “Human capital,” which is required to maximize human capital and promote the human resource strategies linked with the Company’s management strategy. The following table presents the details of the combination of skills and the skills possessed by each individual, including the Executive Officers, along with the Directors.